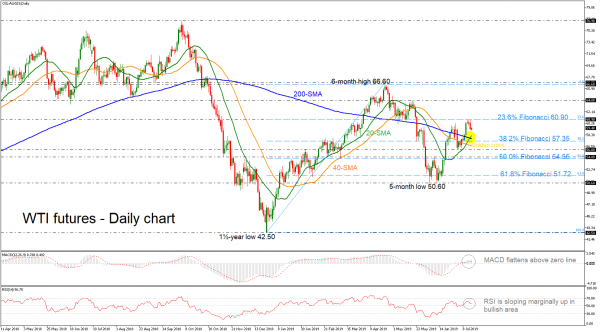

WTI crude oil futures recorded an upside rally last week, but this week the price is on the backfoot after the bounce off the significant barrier of the 23.6% Fibonacci level of the upward wave from 42.50 to 66.60 near 60.90. The technical indicators fail to give clear direction as the MACD is flattening in the positive territory, while the RSI is sloping marginally up. It is worth mentioning that the short-term 20-day simple moving average (SMA) completed a ‘golden cross’ with the long-term 200-SMA.

If the moving averages prove to be strong support to the price near 58.00, immediate resistance is being provided by the 23.6% Fibo of 60.90. Should prices run higher again, the next level would likely come from the 64.00 handle, registered on May 20.

In case of a downward attempt again, oil prices would likely meet support at the 38.2% Fibo of 57.35, before touching the 40-day SMA currently at 56.50 and the 56.00 psychological level. A break below this barrier would open the way towards the 50.0% Fibonacci region around the 54.80 support hurdle.

In the short-term, if the price drops below the five-month low of 50.60, it would switch the bias back to negative, increasing speculation for a test of the one-and-a-half month low of 42.50. Presently, the oil market seems to be cautiously positive, but traders should wait for a daily close above the 23.6% Fibo mark.