The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12141

Open: 1.12069

% chg. over the last day: -0.09

Day’s range: 1.12019 – 1.12106

52 wk range: 1.1111 – 1.2009

EUR/USD continues to consolidate. There is no defined trend. Local levels of support and resistance are: 1.11950 and 1.12300. At the moment, participants in financial markets have taken a wait-and-see attitude before publishing the FOMC Minutes, which may indicate further rates for adjusting the monetary policy of the regulator. We also recommend to pay attention to the speech of the Fed. Positions must be opened from key levels.

At 21:00 (GMT+3:00) the US will publish the FOMC protocols.

Indicators do not give accurate signals: the price is testing 50 MA, which at the moment is a strong dynamic resistance.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell EUR / USD.

The Stochastic Oscillator is in the neutral zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.11950, 1.11600

Resistance levels: 1.12300, 1.12750, 1.13100

If the price consolidates below the local support of 1.11950 the quotes may fall toward 1.11600-1.11400.

Alternatively, the quotes may recover toward 1.12600-1.12800.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25164

Open: 1.24577

% chg. over the last day: -0.44

Day’s range: 1.24479 – 1.24642

52 wk range: 1.2438 – 1.3631

On the GBP / USD currency pair, bearish sentiment still prevails. The trading instrument again updated local minima. At the moment, the key support and resistance levels are: 1.24400 and 1.24900, respectively. The pound remains under pressure due to the uncertainty around Brexit. The main contenders for the post of leader of the Conservative Party have announced that they are ready for the UK to leave the block on a “tough” Brexit basis. Today, investors will be evaluating important economic releases from the UK. We recommend to open positions from key levels.

The Economic News Feed for 10.07.2019:

GDP report – 11:30 (GMT+3:00);

The volume of production in the UK manufacturing industry – 11:30 (GMT+3:00).

The price has fixed below 50 MA and 100 MA, which indicates the strength of the sellers.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell GBP / USD.

The Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.24400, 1.24000

Resistance levels: 1.24900, 1.25350, 1.25600

If the price consolidates below 1.24400, the quotes can fall toward 1.24000.

Alternatively, the quotes can correct to 1.25200-1.25400.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30888

Open: 1.31232

% chg. over the last day: +0.26

Day’s range: 1.31232 – 1.31362

52 wk range: 1.2727 – 1.3664

The USD/CAD continues to recover after a prolonged fall. CAD has reached key extremums and .is consolidating in the range of 1.31150-1.31400. The quotes can correct further. Today the focus is on the meeting o the Bank of Canada. It is expected that the regulator will keep the basic parameters of monetary policy at the same level. We recommend to pay attention to the comments and rhetoric of the representatives of the Central Bank. Positions must be opened from key levels.

At 17:00 (GMT+3: 00), the Bank of Canada will announce its decision on a key interest rate.

The price has fixed above 50 MA and 100 MA, which indicates the power of buyers.

The MACD histogram is in the positive zone and continues to rise, indicating bullish sentiments.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also indicates bullish moods.

Trading recommendations

Support levels: 1.31150, 1.30850, 1.30550

Resistance levels: 1.31400, 1.32000

If the price consolidates above the level of 1.31400, the quotes can rise to 1.32000.

Alternatively, the quotes can fall toward 1.30900-1.30700.

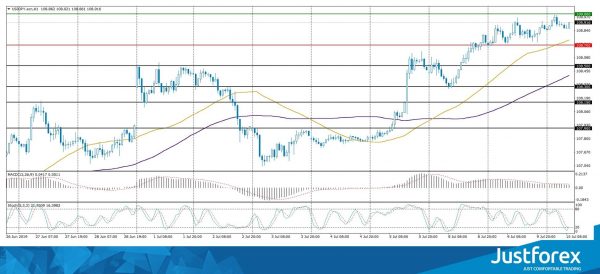

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.720

Open: 108.856

% chg. over the last day: +0.20

Day’s range: 108.829 – 108.991

52 wk range: 104.97 – 114.56

On the USD/JPY currency pair the buyers still prevail. At the moment, the trading instrument is consolidating near the round level of 109.000. Local support is at the 108.700 mark. In the near future, technical correction of the USD/JPY quotes is expected. Investors are awaiting the publication of FOMC protocols. We also recommend paying attention to the dynamics of US government bond yields. Positions must be opened from key levels.

The Economic News Feed for 10.07.2019 is calm.

The price has fixed above 50 MA and 100 MA, which indicates the strength of buyers.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy USD/JPY.

The Stochastic Oscillator is in the oversold zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 108.700, 108.500, 108.300

Resistance levels: 109.000, 109.400, 109.600

If the price consolidates above the round level of 109.000, the quotes can grow to 109.300-109.500.

Alternatively, the quotes can decline to 108.500-108.300.