The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12776

Open: 1.12833

% chg. over the last day: +0.07

Day’s range: 1.12755– 1.12877

52 wk range: 1.1111 – 1.2009

Majors were calm yesterday and there is no defined trend yet. Trading activity and volatility were reduced due to the celebration of the US Independence Day. At the moment, EUR/USD quotes are consolidating. Financial market participants took a wait-and-see position before the publication of the report on the US labor market in June, which may affect the Fed’s views on the further pace of monetary policy adjustment. The key trading range is 1.12750-1.13100. We recommend to open positions from these marks.

At 15:30 (GMT + 3: 00) we expect labor statistics in the United States.

Indicators do not give accurate signals: the price crossed 50 MA.

The MACD histogram is located near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.12750, 1.12400, 1.12000

Resistance levels: 1.13100, 1.13500, 1.13900

If the price consolidates below 1.12750, the EUR/USD quotes are expected to fall to 1.12300-1.12000.

An alternative could be the growth of the EUR/USD currency pair to 1.13500-1.13800.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25647

Open: 1.25763

% chg. over the last day: +0.08

Day’s range: 1.25735 – 1.25848

52 wk range: 1.2438 – 1.3631

The technical picture on the GBP/USD currency pair is still ambiguous. Sterling is in lateral movement. The key support and resistance levels are: 1.25600 and 1.26000, respectively. Investors expect US labor statistics for June. We recommend to pay attention to the difference between the actual and predicted values of the indicators. Positions must be opened from key levels.

The Economic News Feed for 05.07.2019 is calm.

Indicators do not give accurate signals: the price crossed 50 MA.

The MACD histogram is near the 0 mark.

The Stochastic Oscillator is in the neutral zone, the% K line crossed the% D line. At the moment, there are no accurate signals.

Trading recommendations

Support levels: 1.25600, 1.25300, 1.25000

Resistance levels: 1.26000, 1.26350, 1.26650

If the price consolidates below 1.25600, the quotes can drop to 1.25300-1.25000.

Alternatively the quotes can grow toward 1.26400-1.26600.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30595

Open: 1.30492

% chg. over the last day: -0.06

Day’s range: 1.30438 – 1.30665

52 wk range: 1.2727 – 1.3664

The USD/CAD has stabilized after a long fall. CAD is trading in a flat, the following key support and resistance levels can be identified: 1.30400 and 1.30800, respectively. USD/CAD quotes are likely recover. Investors expect labor market reports in the US and Canada. We also recommend to pay attention to the dynamics of oil prices. Positions must be opened from key levels.

At 15:30 (GMT + 3: 00) statistics on the labor market of Canada will be published.

Indicators do not give accurate signals: the price is close to 50 MA, which at the moment is a strong dynamic resistance.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/CAD.

The Stochastic Oscillator is near the overbought zone, the% K line crossed the% D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.30400, 1.30000

Resistance levels: 1.30800, 1.31150, 1.31450

If the price consolidates above 1.30800, correction to 1.31150-1.31400 is expected.

An alternative could be a further fall to the round level of 1.30000.

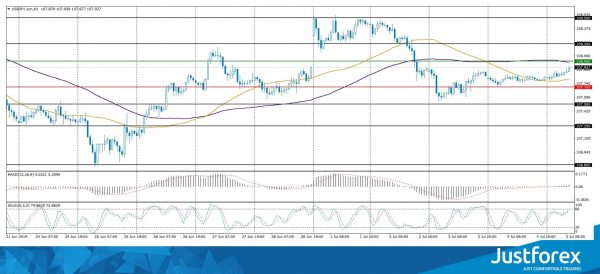

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 107.798

Open: 107.811

% chg. over the last day: +0.02

Day’s range: 107.781 – 107.946

52 wk range: 104.97 – 114.56

The safe haven currency continues to consolidate. Unidirectional trend is not observed. The focus of the report on the US labor market in June. Currently, the local support and resistance levels are 107.700 and 108.000, respectively. We also recommend paying attention to the dynamics of the yield of US government securities. Positions must be opened from key levels.

The Economic News Feed for 05.07.2019 is calm.

Indicators do not give accurate signals: the price is fixed between 50 MA and 100 MA.

The MACD histogram is near 0.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates bullish moods.

Trading recommendations

Support levels: 107.700, 107.500, 107.250

Resistance levels: 108.000, 108.200, 108.500

If the price consolidates below 107.700, the quotes are expected to fall to 107.400-107.200.

An alternative could be the growth of the USD / JPY currency pair to 108.400-108.600.