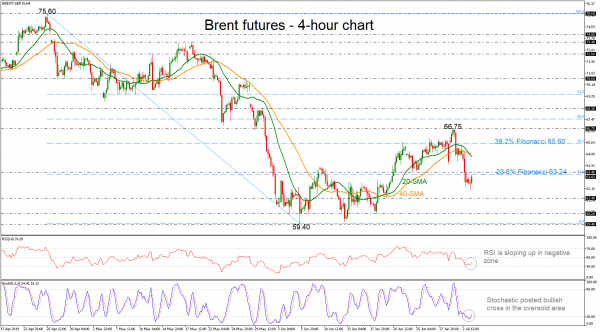

Brent crude oil futures have gained a bit in the last 4-hour session, paring some losses of yesterday’s move. The technical indicators are currently feeding prospects for a possible positive short-term trading as the RSI is pointing up in the negative area and the %K line of the stochastic oscillator is creating a bullish cross with the %D line in the oversold zone, suggesting the end of the bearish phase.

Alternatively, if 63.40 and the 23.6% Fibonacci of the downward wave from 75.60 to 59.40, near 63.24, proves easy to get through, the spotlight will turn to the 38.2% Fibonacci of 65.60 but first they need to surpass the short-term bearish crossover within the SMAs currently at 64.80.

A failure to overcome the 63.40 resistance, could send the price down to the 61.40 support. Lower, the next level could be found around 60.20, while a decisive close below it could stage a steeper sell-off until 59.40.

Summarizing, the oil market seems to turn slightly higher today in the very short-term with the technical indicators suggesting more bullish actions.