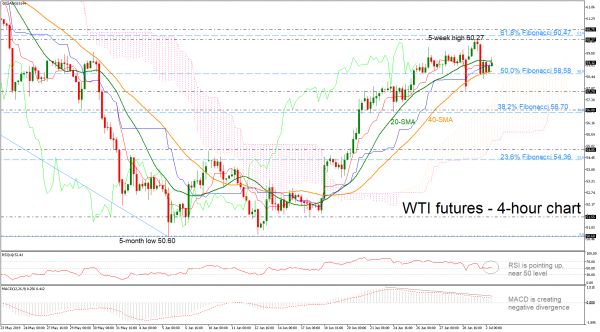

WTI crude oil futures are on course to jump above the 20-simple moving average (SMA) after they found crucial support at the 50.0% Fibonacci retracement level of the downleg from 66.60 to 50.60 near 58.58 over the last sessions.

Having a look at the technical indicators, the MACD oscillator is creating a bearish divergence as it is slipping at the same time that prices are moving higher in the 4-hour chart, suggesting a possible negative correction soon. However, the RSI indicator is pointing upwards marginally above the 50 threshold.

The next resistance is being provided by the five-week high of 60.27 and the 61.8% Fibonacci of 60.47. If prices rise higher again, the 60.75 barrier, taken from the low on May 13 could come in focus.

In case of a downward attempt, oil prices would likely meet support at the 50.0% Fibo (58.58) again, easing upside pressure. A break below this strong hurdle could open the door for a retest of the 57.70 obstacle and the Ichimoku cloud, signaling the start for a potential neutral phase in the very short-term.

Summarizing, WTI crude oil futures have been in a bullish mode over the last three weeks, following the rebound on the 50.60 support barrier. A bearish correction is possible if there is a drop below the 50.0% Fibo, while a climb above the 61.8% Fibo would endorse the bullish picture.