Key Highlights

- The Euro gained momentum and traded towards 1.1420 against the US Dollar.

- EUR/USD is correcting gains, but remains well supported above 1.1300.

- The US Personal Income in May 2019 increased 0.5% (MoM), more than the +0.3% forecast.

- The US ISM Manufacturing Index in June 2019 could decline from 52.1 to 51.0.

EURUSD Technical Analysis

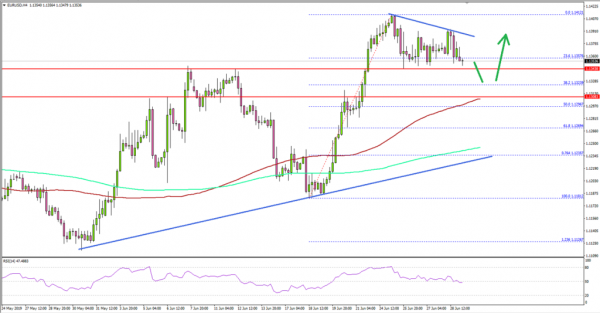

This past week, there was a strong rise in the Euro above 1.1300 against the US Dollar. The EUR/USD pair climbed above the 1.1340 resistance and even spiked above the 1.1400 level.

Looking at the 4-hours chart, the pair formed a new swing high near 1.1412 before it started a downside correction. It traded below the 1.1380 level and the 23.6% Fib retracement level of the upward move from the 1.1182 low to 1.1412 high.

On the downside, there are many supports near the 1.1340, 1.1320 and 1.1300 levels. The main support is near the 1.1300 level and the 100 simple moving average (red, 4-hours).

Besides, the 50% Fib retracement level of the upward move from the 1.1182 low to 1.1412 high is also near the 1.1296 level to act as a decent support. If there are more downsides, EUR/USD could even test the 1.1260 support area.

On the upside, the 1.1400 and 1.1410 levels are initial resistances. A break above the 1.1412 swing high might set the pace for more gains above the 1.1440 level.

Fundamentally, the US Personal Income report for May 2019 was released by the Bureau of Economic Analysis, Department of Commerce. The market was looking for a 0.3% rise in the personal income compared with the previous month.

The actual result was better than the forecast, as the US Personal Income increased 0.5% in May 2019, similar to the last reading. Looking at the Personal Spending, there was a drop from the last revised reading of 0.6% to 0.4% (similar to the forecast).

The report added:

Personal incomeincreased $88.6 billion (0.5 percent) in May according to estimates released today by the Bureau of Economic Analysis. Disposable personal income(DPI) increased $72.6 billion (0.5 percent) and personal consumption expenditures(PCE) increased $59.7 billion (0.4 percent).

Overall, EUR/USD seems to be correcting gains, but it remains well supported near 1.1340 and 1.1300. Similarly, GBP/USD might continue to find bids near the 1.2650 support.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for June 2019 – Forecast 45.4, versus 45.4 previous.

- Euro Zone Manufacturing PMI June 2019 – Forecast 47.8, versus 47.8 previous.

- UK Manufacturing PMI for June 2019 – Forecast 49.2, versus 49.4 previous.

- US Manufacturing PMI for June 2019 – Forecast 50.1, versus 50.1 previous.

- US ISM Manufacturing Index for June 2019 – Forecast 51.0, versus 52.1 previous.