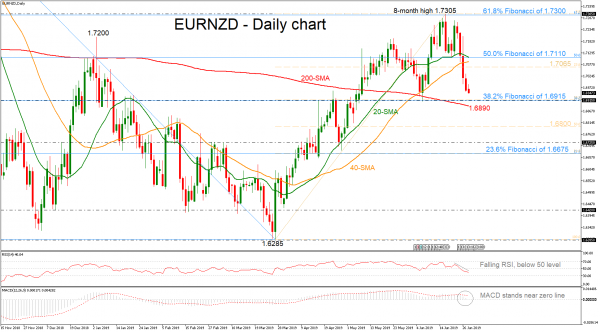

EURNZD lost ground this week, dropping to a new three-week low near 1.6950 today after finding strong resistance at the eight-month high slightly above the 1.7300 psychological mark.

The short-term moving averages are ready to create a bearish cross, signaling more losses, while the technical indicators are losing momentum. The RSI is hovering below the 50 level and the MACD slipped beneath its trigger line and stands near the zero line.

However, should the price close comfortably below the strong support of the 38.2% Fibonacci retracement level of the downfall from 1.7925 – 1.6285, which overlaps with the 38.2% Fibo mark of the upleg from 1.6285 – 1.7305, at 1.6915, this could lead the price to fall towards the 200-day simple moving average (SMA) currently at 1.6890. If there is a drop below these levels, the 1.6800 (50.0% Fibo of the upleg) could act as a strong support level for the bears.

In the positive scenario where the 1.7065 resistance (23.6% Fibo of the upleg) halts upside movements, the market could retest the 50.0% Fibonacci mark of 1.7110 of the downward movement, which stands near the 20-day SMA. If the level proves easy to overcome this time, the increase may next pause somewhere near the 1.7300 handle.

In brief, EURNZD is in a sell-off mode between the short-term and the long-term SMAs. A slip beneath the 200-SMA could open the door for more declines, shifting the bias to neutral, while a run above 1.7300 could rekindle the medium-term buying interest.