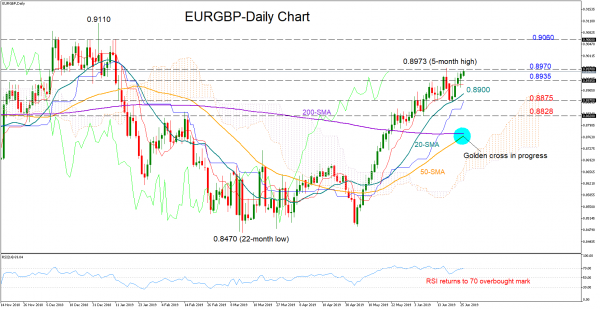

EURGBP found some footing around the 20-day simple moving average (SMA) last week and returned to a bullish trend thereafter.

The price is currently testing the recent five-month peak of 0.8973 and a former restrictive area, where any decisive close higher may prove valuable to the market. The red Tenkan-sen however remains flat above the blue Kijun-sen and the RSI is currently flirting with overbought levels, pointing to a softer short-term trading.

A pullback may meet immediate support around the 0.8935 barrier, while slightly lower the bears could try to overcome the 20-day SMA currently near 0.8900 and the 0.8875 levels. Should the price retreat under the 0.8828 number too, the April upward pattern could come under speculation.

In the positive scenario, the pair could improve above the five-month high of 0.8973 to challenge a stronger resistance around 0.9060. The 0.9100 area, however, which strictly capped bullish action last year, remains the big highlight.

Meanwhile, in the medium-term picture, the situation seems to be getting more interesting as the 50-day SMA and the 200-day SMA are heading for a golden cross. Should the lines intersect each other and then keep some distance between them, the positive outlook may turn even brighter.

In brief, EURGBP is expected to pause the run to the north in the short-term, while in the medium-term, buying interest could advance if the market confirms a golden cross between the 50- and the 200-day SMA.