EUR/USD gained momentum and traded towards the 1.1410 level before correcting lower. USD/CHF declined close to the 0.9690 level and it is currently recovering.

Important Takeaways for EUR/USD and USD/CHF

- The Euro climbed higher in the past few days and broke the 1.1380 resistance against the US Dollar.

- There is a key bullish trend line forming with support near 1.1345 on the hourly chart of EUR/USD.

- USD/CHF declined heavily and traded to a new monthly low near the 0.9693 level.

- The pair is currently testing a major bearish trend line with resistance at 0.9765 on the hourly chart.

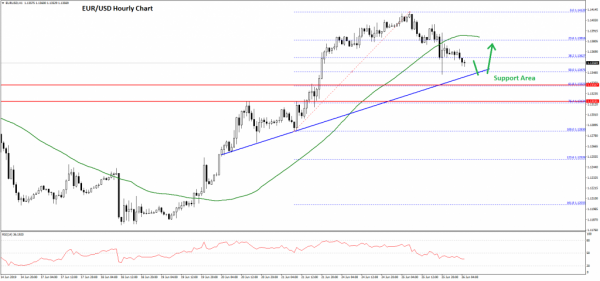

EUR/USD Technical Analysis

The Euro started a steady rise after forming a support base near the 1.1190 level against the US Dollar. The EUR/USD pair climbed above the 1.1240 and 1.1280 resistance levels. The pair even gained momentum above the 1.1350 resistance area.

Finally, the pair surged above the 1.1380 level and the 50 hourly simple moving average. It traded to a new monthly high at 1.1412 on FXOpen and recently started a downside correction.

It broke the 1.1380 support plus the 23.6% Fib retracement level of the last wave from the 1.1283 low to 1.1412 high. There was a close below 1.1380 and the 50 hourly simple moving average.

However, the 1.1350 level is acting as a strong support. Moreover, the 50% Fib retracement level of the last wave from the 1.1283 low to 1.1412 high is acting as a support.

Additionally, there is a key bullish trend line forming with support near 1.1345 on the hourly chart of EUR/USD. If the pair fails to stay above the trend line support, there could be more losses.

The next key support is near the 1.1330 level, below which the pair might test the 1.1315 pivot level. On the upside, an initial resistance is near the 1.1380 level and the 50 hourly SMA. If there is a fresh increase above 1.1380, EUR/USD is likely to revisit the 1.1410 level in the near term.

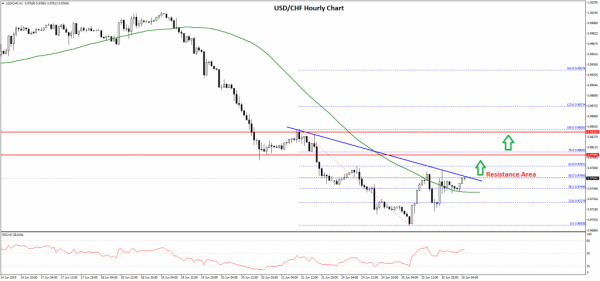

USD/CHF Technical Analysis

The US Dollar started a significant downward move from well above the 1.0000 level against the Swiss franc. The USD/CHF pair broke the 0.9950 and 0.9920 support levels to move into a bearish zone.

The pair even broke the 0.9850 support and settled below the 50 hourly simple moving average. Finally, there was a break below the 0.9750 support and the pair traded as low as 0.9693.

Recently, it started an upside correction above the 0.9700 and 0.9720 levels. There was a break above the 38.2% Fib retracement level of the last decline from the 0.9838 high to 0.9693 swing low.

Furthermore, there was a break above 0.9750 and the 50 hourly simple moving average. However, the pair is now facing a strong resistance near the 0.9765 level.

The 50% Fib retracement level of the last decline from the 0.9838 high to 0.9693 swing low is also acting as a hurdle for the bulls. There is also a major bearish trend line forming with resistance at 0.9765 on the hourly chart.

If USD/CHF clears the trend line resistance, there are chances of more gains in the near term. In the mentioned case, it could trade towards the 0.9800 or 0.9820 level.

Conversely, if there is no break above 0.9765 and 0.9770, the pair may perhaps slide again. An immediate support is near 0.9745, followed by the 0.9700 handle.