The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.12260

Open: 1.12942

% chg. over the last day: +0.61

Day’s range: 1.12872 – 1.13091

52 wk range: 1.1111 – 1.2009

EUR/USD stabilized after rapid growth. Right now the trending instrument is consolidating. The local support and resistance levels are 1.12700-1.13100. USD remains under pressure due to the dowish Fed policy. The regulator is willing to lower the rates at the next few meetings. Review several releases from the EU and the US and open positions from the key levels.

The Economic News Feed for 21.06.2019:

Business Activity Report (EU) – 10:30 (GMT+3:00);

Secondary Real Estate Sales (EU) – 17:00 (GMT+3:00);

The price fixed above 50 MA and 100 MA which points to the power of the buyers.

The MACD histogram is in the positive zone but below a signal line which gives a weak signal to buy EUR/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line which points towards correctino of EUR/USD.

Trading recommendations

Support levels: 1.12700, 1.12400, 1.12100

Resistance levels: 1.13100, 1.13400

If the price fixes above 1.13100, expect further growth towards 1.13400-1.13600.

Alternatively, the quotes can fall towards 1.12500-1.12300.

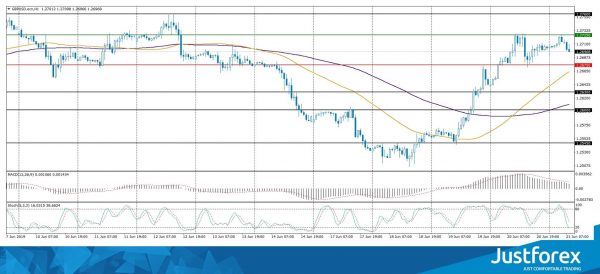

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.26408

Open: 1.27033

% chg. over the last day: +0.53

Day’s range: 1.26903 – 1.27247

52 wk range: 1.2438 – 1.3631

GBP/USD is moving sideways. There is no defined trend. GBP is testing the key support and resistance levels are 1.26750-1.27250. The Bank of England kept the monetary policy at the same level. The regulator has worsened the economy growth forecasts for the country. The Central Bank is also worried about the high-stress environment in the world trade and the Brexit ambiguousness. Keep an eye on the US economic reports and open positions from the key levles.

The Economic News Feed for 21.06.2019 is calm.

The price fixed above 50 MA and 200 MA which points to the power of the buyers.

The MACD histogram is in the positive zone but below the signal line which gives a weak signal to buy GBP/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line which points towards a correctino of GBP/USD.

Trading recommendations

Support levels: 1.26750, 1.26300, 1.26000

Resistance levels: 1.27250, 1.27600

If the price fixes above 1.27250, expect further growth towards 1.27600-1.27800.

Alternatively, the quotes can descend towards 1.26400-1.265200.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.32787

Open: 1.31897

% chg. over the last day: -0.72

Day’s range: 1.31622 – 1.31960

52 wk range: 1.2727 – 1.3664

USD/CAD is consolidating after a rapid fall since the beginning of the week. The key support and resistance levels are 1.31600 and 1.32200. USD remains under pressure. A technical correction is possible soon. We expect important report from Canada. Keep an eye on the oil quotes dynamics and open positions from the key levels.

At 15:30 (GMT+3:00) Canada will publish a retail sales report.

The price is fixed below 50 MA and 200 MA which points to the power of the buyers.

The MACD histogram is in the negative zone but above the signal line which gives a weak signal to sell USD/CAD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line which points towards a correction of USD/CAD.

Trading recommendations

Support levels: 1.31600, 1.31300, 1.31000

Resistance levels: 1.32200, 1.32500, 1.33000

If the price fixes below 1.31600 local support, expect further descend towards 1.31300-1.31000.

Alternatively, the quotes can correct towards 1.32500-1.32800.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.099

Open: 107.288

% chg. over the last day: -0.74

Day’s range: 107.049 – 107.370

52 wk range:: 104.97 – 114.56

USD/JPY remains in a bearish mood. Right now the trading instrument is testing the key minimums. The local support and resistance levels are 107.000 and 107.400. The demand for USD remains low after the Federal Reserve meeting. The USD/JPY quotes have prospects for further descend. Keep an eye on the US Treasury bonds’ yield and open positions from the key levels.

The Economic News Feed for 21.06.2019 is calm.

The price fixed below 50 MA and 100 MA which points to the power of the buyers.

The MACD histogram is in the negative zone but above the signal line which gives a weak signal to sell USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line which points towards a recovery of USD/JPY.

Trading recommendations

Support levels: 107.000, 106.500

Resistance levels: 107.400, 107.600, 107.850

If the price fixes below 107.000, epxect further growth towards 106.600-106.400.

Alternatively, the quotes can grow towards 107.600-107.850.