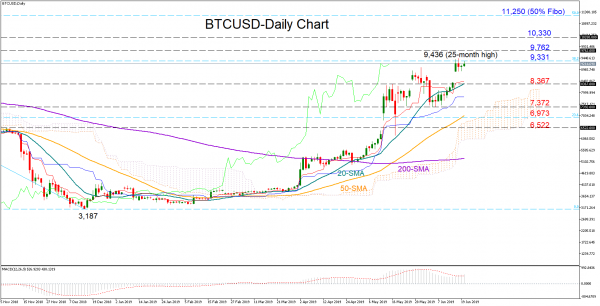

Bitcoin is stubbornly testing the 38.2% Fibonacci ratio of the long 19,384-3,187 bearish wave for the fourth consecutive session that the bulls failed to successfully breach a year ago. While the slowdown in the red Tenkan-sen and the blue Kijun sen could be a warning sign that the bullish action may soon fade, the market could chart another rally if the MACD continues to trend higher and above its red signal line.

Crossing above the 38.2% Fibo of 9,331, nearby resistance could be detected around 9,762, taken from the peak on April 2018. Should the market beat the 10,330 congested area too, the door would open for the 50% Fibo of 11,250.

On the flip side, a decisive close below 8,367 and the 20-day simple moving average (SMA) could be followed by additional losses towards the 7,372 support level before attention shifts to the 23.6% Fibo of 6,973. Deeper, a drop under 6,522 could provide more comfort to the bears, shifting the bigger picture from positive to neutral. Yet the latter may take some time as the 50-day SMA shows no sign of correcting its bullish cross with the 200-day SMA.

In brief BTCUSD is looking cautiously positive in the short-term and bullish in the medium-term.