The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.11924

Open: 1.12260

% chg. over the last day: +0.38

Day’s range: 1.12257 – 1.12730

52 wk range: 1.1111 – 1.2009

Yesterday USD got weakened against the majors. The EUR/USD set the new local maximums. As expected, the Federal Reserve kept the key interest rate at 2.25-2.50% and released mixed economic forecasts. The Central Bank made it known that it’s willing to review the softening of the monetary policy due to growing stress on the world economy and relatively weak inflation. The statement that the Central Bank is willing to remain calm about the further corrections of the interest rates disappeared from the FOMC communique. According to the CME FedWatch Tool 57.4% of market participants expect the range to decrease by 25 points in July, while 42.6% expect it to drop by 50 basis points. The key trading range for EUR/USD is 1.12400-1.12700. The quotes can grow further. You should open positions from the key levels.

At 15:30 (GMT+3:00) the Philadelfia Federal Reserve will release the Manufacturing Index.

The price fixed above 50 MA and 100 MA which points to the power of the buyers.

The MACD histogram is in the positive zone and above the signal line which gives a strong signal to buy EUR/USD.

The Stochastic Oscillator is in the overbought zone, the %K line is crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.12400, 1.12100, 1.11800

Resistance levels: 1.12700, 1.13000, 1.13250

If the price fixes above 1.12700, expect further growth towards 1.13000-1.13250.

Alternatively, the quotes can descend towards 1.12100-1.11900.

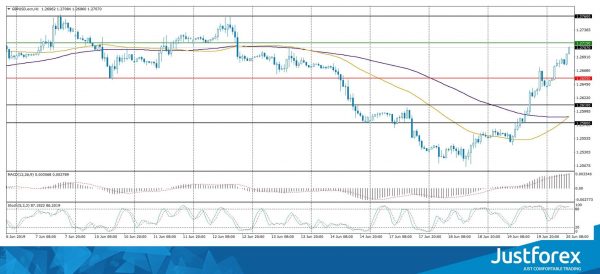

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25566

Open: 1.26408

% chg. over the last day: +0.78

Day’s range: 1.26259 – 1.27084

52 wk range: 1.2438 – 1.3631

GBP/USD shows agressive sales. During the last two days the quotes grew by 150 points. GBP pdated the key maximums, the demand for USD grows. GBP is testing the local resistance at 1.27150 with 1.26550 actiong as a key support. The investors are focused on the meeting of the Bank of England. The regulator will leave the monetary policy parameters the same. Keep an eye on the comments by the representatives and open positions from the key levels.

The Economic News Feed for 20.06.2019:

Retail Sales Report (UK) – 11:30 (GMT+3:00);

Monetary Policy Review (UK) – 14:00 (GMT+3:00);

The price fixed above 50 MA and 100 MA which points to the power of the buyers.

The MACD histogram is in the positive zone and keeps rising which gives a strong signal to buy GBP/USD.

The Stochastic Oscillator is in the overbought zone, the %K line is crossing the %D line. There are no signals.

Trading recommendations

Support levels: 1.26550, 1.26100, 1.25800

Resistance levels: 1.27150, 1.27600

If the price fixes above 1.27150, expect further growth towards 1.27600-1.27800.

Alternatively, the quotes can descend towards 1.26300-1.26000.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.33780

Open: 1.32787

% chg. over the last day: -0.79

Day’s range: 1.32277 – 1.32854

52 wk range: 1.2727 – 1.3664

USD/CAD is in a strong descending trend. During the last two days the quotes fell by 140 points. The trading instrument updated the key minimums. The demand for USD weakened after the Federal Reserve meeting. CAD is supported by the positive oil quotes trends. The quotes are testing the support at 1.32250 with 1.32600 actng as the nearest resistance. The USD/CAD can descend further. Open positions from the key levels.

The Economic News Feed for 20.06.2019 is calm.

The price is below 50 MA and 100 MA which points to the power of the sellers.

The MACD histogram is in the negative zone and below the signal line which gives a strong signal to sell USD/CAD.

The Stochastic Oscillator is in the overbought zone, the %K line is crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.32250, 1.32000, 1.31700

Resistance levels: 1.32600, 1.33000, 1.3320

If the price fixes below 1.32250, expect further descend towards 1.32000-1.321700.

Alternatively, the quotes can recover towards 1.32800-1.33000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 108.446

Open: 108.099

% chg. over the last day: -0.31

Day’s range: 107.467 – 108.143

52 wk range: 104.97 – 114.56

USD/JPY quotes started to descend after long consolidation. The quotes updated the local extremums. Right now they are consolidating around the local support at 107.500 with 107.900 acting as a mirror resistance. JPY has a tendency to grow further against the USD. Keep an eye on the US Treasury bonds’ yield and open positions from the key levels.

The Bank of Japan kept the monetary policy at the same levels, as expected.

The price fixed below 50 MA and 100 MA which points to the power of the sellers.

The MACD histogram is in the negative zone and below the signal line which gives a signal to sell USD/JPY.

The Stochastic Oscillator is in the overbought zone, the %K line is crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 107.550, 107.000

Resistance levels: 107.900, 108.200, 108.500

If the price fixes below 107.550, expect further descend towards 107.000.

Alternatively, the quotes can grow towards 108.100-108.300.