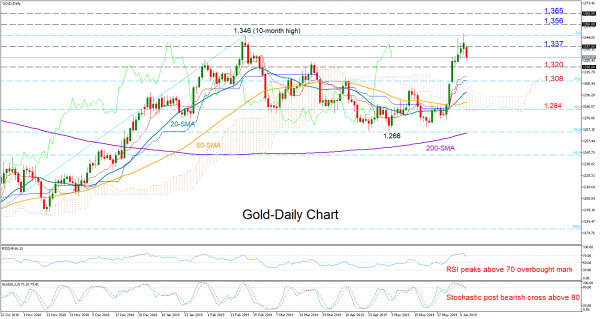

Gold recorded its best weekly performance so far this year, topping near a former key resistance of 1,346 on Friday. The RSI and the Stochastics, however, indicated that the bulls are exhausted as the measures peaked in overbought territory – letting the bears take over on Monday. Yet, with the 20-day simple moving average (SMA) increasing its distance above the 50-day SMA, the positive market trend may likely extend forward in the short-term.

Should the market close comfortably below the 1,320 level, the bearish action may extend towards the upper surface of the Ichimoku cloud and the 23.6% Fibonacci of the long uptrend from 1,183 to 1346 – near 1,308. Another step lower, could open the door for the 38.2% Fibonacci of 1,283.95.

In case of a rebound, today’s high of 1,337 could provide immediate resistance, while higher, the bulls will find it harder to clear the 1,346 top. Breaking that wall, the price may pause around the 1,356 barrier before an even more challenging battle starts at 1,365. The latter level has not been breached since 2013.

Meanwhile in the medium-term timeframe, conditions are still neutral, with the price ranging within the 1,346-1,266 area. The reversal in the 50-day SMA suggests that a bear market is not yet a serious threat.

In brief, the risk is skewed to the downside in the short-term as the market is currently looking overbought, while in the medium-term, the outlook remains neutral.