Key Highlights

- The Euro started a steady rise above the 1.1250 resistance against the US Dollar.

- EUR/USD is currently placed above 1.1300 and it could surpass 1.1350.

- The US nonfarm payrolls in May 2019 came in at 75K, less than the 185K forecast.

- The Euro Zone Sentix Investor Confidence in June 2019 could decline from 5.3 to 1.4.

EURUSD Technical Analysis

This past week, the Euro started a strong rise from the 1.1200 swing low against the US Dollar. The EUR/USD pair broke the 1.1250 resistance area to move into a positive zone.

Looking at the 4-hours chart, the pair surpassed a major bearish trend line and even climbed above the 1.1280 plus 1.1300 barrier. It opened the doors for more gains and the pair is now trading well above the 100 simple moving average (red, 4-hours).

The upward move was such that the pair traded close to 1.1350. A swing high was formed at 1.1347 and it is currently correcting gains.

An initial support is at 1.1315 and the 23.6% Fib retracement level of the recent wave from the 1.1200 low to 1.1347 high.

If there is an extended downside correction, the pair could find support near the 1.1280 level. The 50% Fib retracement level of the recent wave from the 1.1200 low to 1.1347 high is also near the 1.1274 level to provide support.

On the upside, a break above the 1.1350 resistance could open the doors for more gains in the coming sessions.

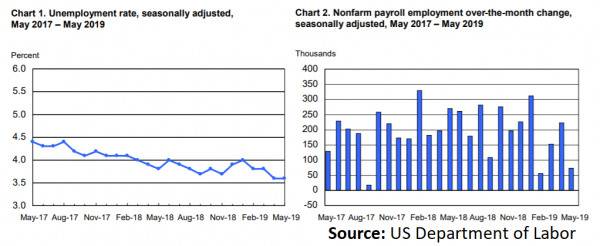

Fundamentally, the US nonfarm payrolls report for May 2019 was released by the US Department of Labor. The market was looking for a decline from 263K to 185K.

However, the actual result was disappointing since the total nonfarm payroll employment edged up only 75K in May, and the unemployment rate remained at 3.6 percent. The last reading was revised down from 263K to 224K.

The report stated that:

The unemployment rate remained at 3.6 percent in May, and the number of unemployed persons was little changed at 5.9 million.

Overall, EUR/USD is likely to continue higher as long as it is trading above the 1.1280 and 1.1250 support levels.

Economic Releases to Watch Today

UK Industrial Production for April 2019 (MoM) – Forecast +0.1%, versus +0.7% previous.

UK Manufacturing Production for April 2019 (MoM) – Forecast +0.2%, versus +0.9% previous.

Euro Zone Sentix Investor Confidence for June 2019 – Forecast 1.4, versus 5.3 previous.