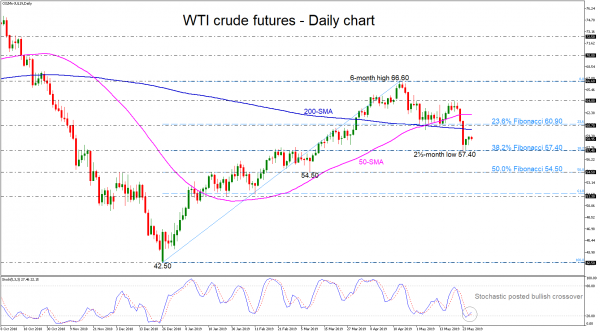

WTI crude oil futures found strong support at a fresh two-and-half-month low of 57.40, where the 38.2% Fibonacci retracement level of the upward rally from 42.50 to 66.60 is standing. The price drifted below the ‘golden cross’ of the 50- and 200-simple moving averages (SMAs) in the daily timeframe, while the stochastic is raising chances for bullish correction at it created a positive cross within the %K and %D lines in the oversold zone.

Should the price edge higher, positive momentum could probably last until the 200-day SMA currently at 60.23, while slightly higher the 60.70 resistance and the 23.6% Fibonacci of 60.90 could act as strong resistance levels. More upside tendency could open the door for the 50-day SMA around 62.20 ahead of the 64.00 handle.

On the downside, the 38.2% Fibonacci mark of 57.40 could act as significant support once again. A failure to hold above this level could strengthen the sell-off towards the 50% Fibonacci of 54.50.

In brief, WTI oil futures are looking more positive in the medium-term, however, in the near-term the price remains below the ‘golden cross’ formation but the stochastic indicates positive retracement.