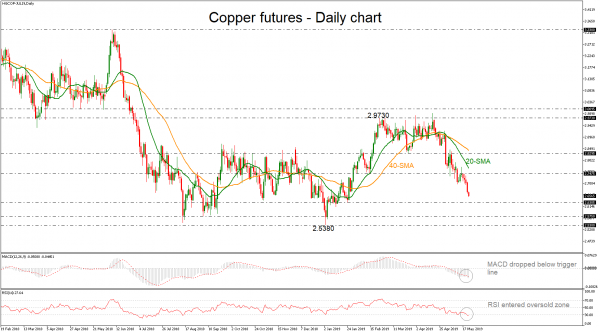

Copper futures with delivery on July 2019 are falling below the 20- and 40-simple moving averages (SMAs) in the daily chart. Moreover, the technical indicators remain in bearish territory, with the RSI sloping down in oversold zone and the MACD oscillator is still endorsing the bearish view as it is weakening below its trigger line.

In case the price extends the bearish move, the next immediate support is expected to come from the 2.6305 barrier. A significant penetration of this line would drive prices lower until the 2.5380 – 2.5750 region.

On the other hand, if there is an upside reversal, the price could reach the 2.7475 resistance taken from the inside swing bottom on February 14. Above this line, the 20-day SMA currently at 2.7680 could halt bullish movements before challenging the 2.8295 resistance.

Briefly, copper prices maintain a bearish bias after the pullback on 2.9730, posting a fresh four-month low of 2.6545.