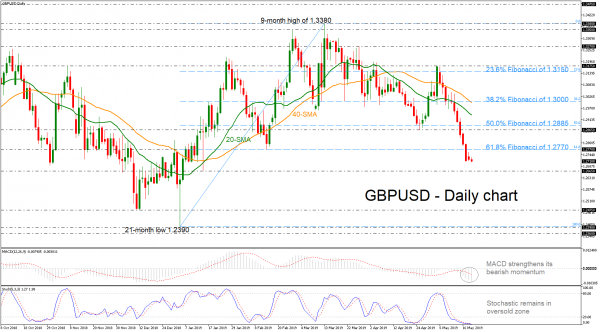

GBPUSD sank to a fresh four-month low of 1.2708 today, creating a strong negative rally after the pullback on 1.3175.

The negative bias in the near term is supported by the deterioration in the momentum indicators. The %K line of the stochastic oscillator has fallen sharply into oversold levels and is attempting a bullish crossover with the %D line. However, the MACD is strengthening its bearish momentum.

If prices continue to head lower, support should come from the 1.2665 barrier, taken from the lows on January 15, while a successful penetration of this level could reinforce the short-term strong downward movement and open the way towards the 1.2475 hurdle.

On the other side, should an upside correction take place, immediate resistance could be faced near the 61.8% Fibonacci retracement level of the upleg from 1.2390 to 1.3380, around 1.2770. If there is a break above this significant area, the price could jump towards 1.2865 and the 50.0% Fibonacci of 1.2885 zone.

In brief, the decline beneath the 61.8% Fibonacci has endorsed the bearish run in the short-term and traders can now turn their attention to critical levels. Only a jump above the near-term moving averages could switch the bias back to positive.