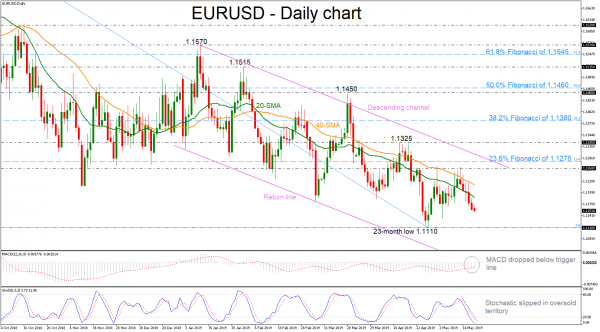

Since its deep fall towards a two-week low in early May, EURUSD slipped beneath the 20- and 40-simple moving averages (SMAs) in the daily timeframe, remaining in a descending channel of its drop from 1.1570. The technical picture supports that the 1.1260 resistance is likely to continue to hold in the short-term.

Looking at momentum indicators, the MACD declined below its trigger line and zero line, suggesting that the market could keep losing momentum in the near term. The stochastic also supports this view in the oversold territory.

If prices continue to head lower, support should come from the 23-month low of 1.1110. A drop below this level would reinforce the medium-term bearish view and open the way towards the return line of the downward sloping channel around the 1.1000 handle, before resting the 1.0900 support, registered on March 2017.

However, should an upside reversal take form, immediate resistance would likely come from the 20- and 40-SMAs currently at 1.1190 and 1.1220 correspondingly. Even higher, the 1.1260 resistance and the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1110 near 1.1275 could attract traders’ attention.

In brief, EURUSD is heading sharply lower over the last five days in the descending channel, suggesting more losses in the short-term.