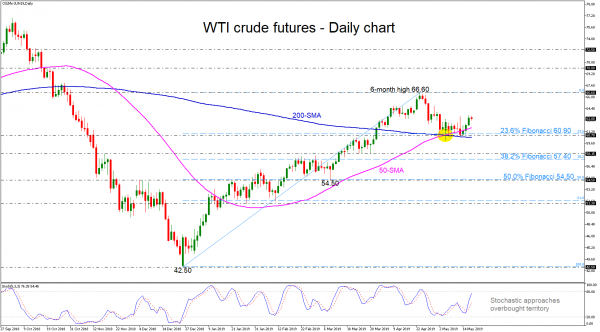

WTI crude oil futures found strong support at the 23.6% Fibonacci retracement level from the one-and-a-half-year low of 42.50 to the recent peak of 66.60 over the last two weeks, remaining also above of the ‘golden cross’ within the 50- and 200-day simple moving averages (SMAs). The stochastic oscillator is approaching the overbought levels, giving signals for more upside pressure.

Should the price edge higher, positive momentum could probably last until the six-month high of 66.60. Beating this top, the way could open towards the 70.00 handle, identified by the peak on October 2018, while more gains could lead oil until the 72.50 resistance.

On the downside, the 23.6% Fibonacci mark of 60.90 could act as significant support once again. A failure to hold above this level and therefore above the 50- and the 200-day SMAs could strengthen the sell-off towards the 58.15 barrier and the 38.2% Fibonacci of 57.40. A decline under the 50% Fibonacci of 54.50 may have a bigger negative impact on the sentiment.

In brief, WTI oil futures are looking more positive in the medium-term thanks to the ‘golden cross’ formation and the positive bias of the stochastic.