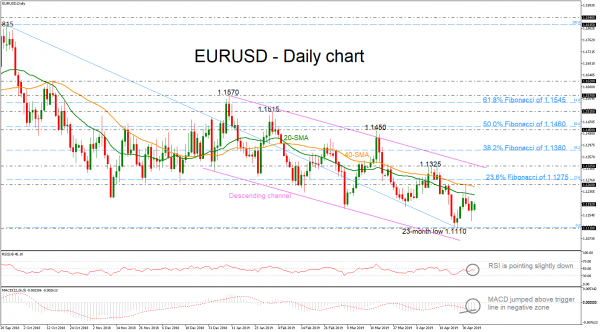

EURUSD has recovered somewhat after the aggressive drop towards the 23-month low of 1.1110 on April 26, stretching further the its medium-term descending channel. Currently, the price is still hovering beneath the 20- and 40-simple moving averages (SMAs) in the daily timeframe, while the momentum indicators hold in bearish territory. The RSI is pointing down; however, the MACD surpassed the trigger line, suggesting a possible upside retracement.

The 1.1200 region is keeping the bulls under control and any jump above that region would send prices until the 20- and 40-SMAs around 1.1225 and 1.1253 respectively. Slightly above these lines the 1.1260 barrier and the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1110 near 1.1275 are located. Should the bulls beat the aforementioned obstacles the price could hit the 1.1325 resistance, which stands near the downtrend line.

On the other hand, a continuation of the downward movement could drive prices until the 1.1110 level again, while in case of steeper decreases, the pair could hit the 1.0900 psychological hurdle, identified by the peaks on March 2017.

Summarizing, in the medium-term picture, the outlook has turned even more bearish after the slip towards the 23-month trough and the continuation of the bearish channel over the last four months.