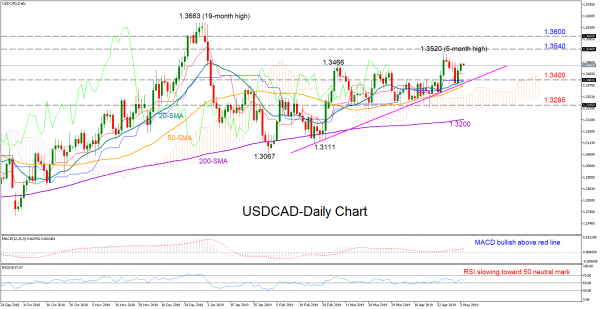

USDCAD bounced on the 20-day simple moving average (SMA) on Wednesday, switching its weekly status from negative to positive, a move that also kept the three-month trend to the upside. The risk is currently viewed as bullish-to-neutral as on the one hand the RSI seems to be changing direction southward to meet its 50 neutral mark, but the red Tenkan-sen is on a sideways move above the blue Kijun-sen and the MACD is increasing strength above its red signal line.

The bulls could set a target between the five-month high of 1.3520 and a former resistance of 1.3540, a break of which would open the way toward the 1.3600 barrier. Beyond the latter, the spotlight will turn to the 1.3663 top, where any close higher would bring the paused September 2017 uptrend back into play.

Otherwise, the 20-day SMA at 1.3400 could be watched in case of a negative correction. Should there be additional losses, the next support could be around the 1.3285 restrictive level. A failure to hold above that number could then lead the price toward the 200-day SMA (1.3220).

Meanwhile in the medium-term picture, USDCAD is weakly positive as long as the pair trades slightly above 1.3375. The positive slope in the 50-day SMA which has recently turned steeper and the increasing distance from the 200-day SMA suggests that a brighter outlook is possible.