The USDJPY pair fell in Asia and extends weakness at the beginning of European session on Thursday after Bank of Japan kept interest rates unchanged and said it would keep ultra-low rates at least until Q1 2020.

The central bank also announced it will keep highly accommodative monetary policy, but lowered inflation projection, saying that 2% target won’t be reached until early 2022.

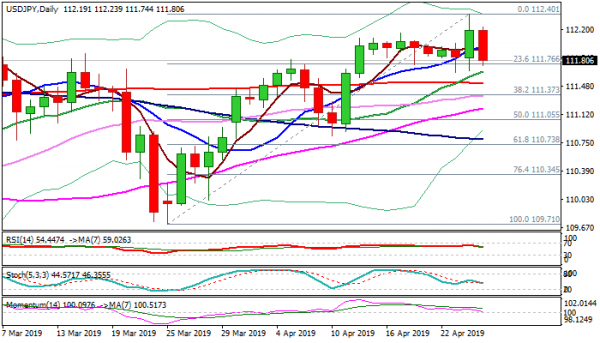

The pair pulled back from new 2019 high at 112.40, posted after strong rally in late Wednesday’s trading, as traders rushed into US Treasuries.

Recent congestion floor (111.65, reinforced by rising 20SMA) came under pressure again and probes below would risk test of pivotal supports at 111.51/37 (200SMA / Fibo 38.2% of 109.71/112.40) loss of which would generate bearish signal.

Weakening momentum ad south-heading daily indicators add to scenario, as the pair is on track for the third consecutive failure to close above 200WMA (currently at 111.91), break of which is needed to signal continuation of larger uptrend from 104.59 (2019 low).

Cracked Fibo barrier at 112.19 (76.4% of 114.54/104.59) and Wed’s high at 112.40 mark pivotal barriers.

Res: 111.91, 112.19, 112.40, 112.60

Sup: 111.65, 111.51, 111.37, 111.20