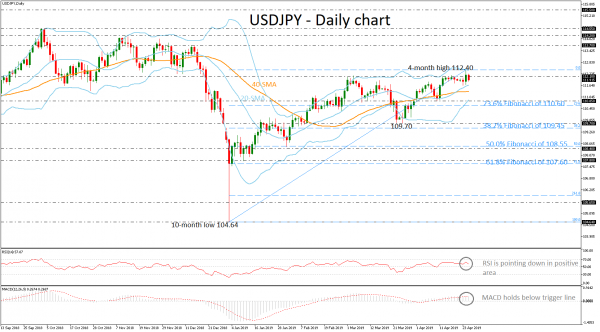

USDJPY had a successful jump above the 112.00 handle on Wednesday, flirting with a fresh four-month high of 112.40. The price rebounded on the mid-level of the Bollinger Band (20-SMA) and hit the upper Boundary, which seems to be a real struggle for the bulls. Technically, the price could lose some ground in the short-term as the RSI is sloping down in the positive territory, while the MACD remains below its trigger line.

If the price declines and drops beneath the 20- and 40-simple moving averages (SMAs), the next immediate support to watch is the 110.85 barrier, which coincides with the lower Bollinger Band. Further losses could send prices slightly lower until the 23.6% Fibonacci of the upleg from 104.64 to 112.40, near 110.60.

Alternatively, another jump above yesterday’s high could open the door for the 113.70 resistance barrier, taken from peak on December 2018, ahead of the top on November 2018 around 114.20.

In brief, USDJPY is pointing up over the past three months, framing a positive profile. A rally above 112.40 would extend the upward trend off the ten-month low of 104.64, making the outlook even more bullish.