Key Highlights

- The Euro declined this past week and broke the 1.1250 support against the US Dollar.

- EUR/USD is following a bearish trend line with resistance at 1.1235 on the 4-hours chart.

- The US Nonfarm Payrolls in March 2019 increased 196K, better than the 180K forecast.

- The US Factory Orders in Feb 2019 might decline around 0.6% (MoM).

EURUSD Technical Analysis

The Euro started a significant decline from well above the 1.1380 support against the US Dollar. The EUR/USD pair declined below the 1.1350 and 1.1250 support levels to move into a downtrend.

Looking at the 4-hours chart, the pair broke many supports recently near the 1.1300, 1.1250 and 1.1240 levels. There was even a close below the 1.1250 support, the 100 simple moving average (4-hours, red), and the 200 simple moving average (4-hours, green).

The pair traded close to the 1.1180 support and later started an upside correction. There was a break above the 23.6% Fib retracement level of the last decline from the 1.1331 high to 1.1183 low.

However, the recent rise faced a strong resistance near the 1.1250 level plus the 50% Fib retracement level of the last decline from the 1.1331 high to 1.1183 low. There is also a bearish trend line in place with resistance at 1.1235 on the same chart.

Therefore, a clear break above 1.1235 and 1.1250 is must for a decent recovery towards 1.1300 in the near term. If not, EUR/USD is likely to decline further towards 1.1180 or 1.1150.

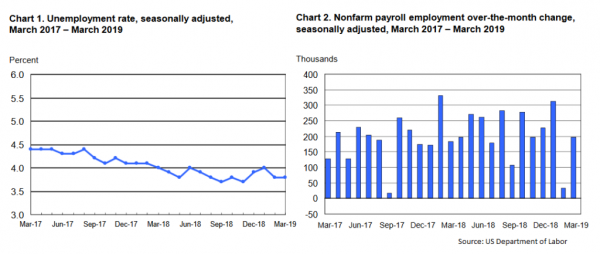

Fundamentally, the US Nonfarm Payrolls report for March 2019 was released by the US Department of Labor. The market was looking for a solid increase of 180K, a lot more than the last 20K.

The actual result was better than the forecast, as the total Nonfarm Payrolls employment increased by 196K in March 2019. Besides, the last reading was revised up from 20K to 32K. The US unemployment rate remained stable at 3.8%.

The report added:

The labor force participation rate, at 63.0 percent, was little changed over the month and has shown little movement on net over the past 12 months. The employment-population ratio was 60.6 percent in March and has been either 60.6 percent or 60.7 percent since October 2018.

Overall, EUR/USD and GBP/USD are trading in a bearish zone and remains at a risk of more losses if the US Dollar bulls remain in action in the near term.

Economic Releases to Watch Today

- Germany’s Trade Balance for Feb 2019 – Forecast €17.0B, versus €18.5B previous.

- US Factory Orders Feb 2019 (MoM) – Forecast -0.6%, versus +0.1% previous.