Gold price declined recently and traded below the $1,300 support area. Crude oil price seems to be forming a short term top below $63.00 and it could decline below $62.00

Important Takeaways for Gold and Oil

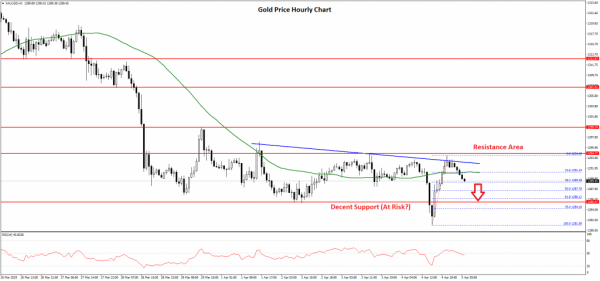

- Gold price started a major drop and traded below the $1,300 support level against the US Dollar.

- There is a key connecting bearish trend line in place with resistance near $1,292 on the hourly chart of gold.

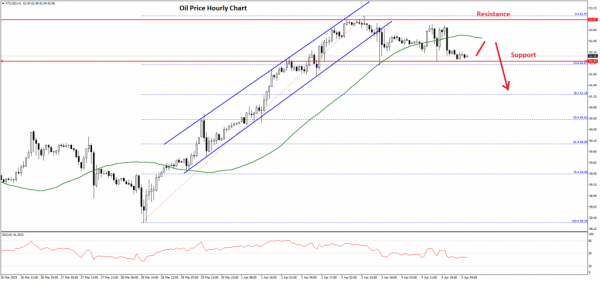

- Crude oil price broke a significant ascending channel with support at $62.60 on the hourly chart of XTI/USD.

- The price is currently at a risk of more losses below the $62.00 and $61.60 support levels.

Gold Price Technical Analysis

Gold price started a major downside move after it failed to stay above the $1,315 support level against the US Dollar. The price declined below the $1,308 and $1,305 support levels to move into a bearish zone.

Finally, the price broke the $1,300 support and settled below the 50 hourly simple moving average. The decline gained pace below $1,295 and the price even broke the $1,290 support. A new swing low was formed at $1,281 on FXOpen and the price recently recovered higher.

It moved above the $1,290 level, but sellers defended the $1,294 resistance area. There is also a key connecting bearish trend line in place with resistance near $1,292 on the hourly chart of gold.

The price is moving lower again and is currently trading below the $1,290 level and the 50 hourly simple moving average. It is likely to test the 50% Fib retracement level of the recent wave from the $1,281 low to $1,294 high.

However, the main support is near the $1,285 level and the 61.8% Fib retracement level of the recent wave from the $1,281 low to $1,294 high. If there is a break below the $1,285 support area, the price is likely to test the $1,280 level.

Should sellers remain in control, the price may even test the $1,272 level. On the upside, the price must settle above the trend line resistance and the $1,295 level to start a decent rebound in the near term.

Oil Price Technical Analysis

Crude oil price started a nasty upward move from the $58.30 swing low against the US Dollar. The price rallied steadily and broke the $60.00 and $62.00 resistance levels.

The price even broke the $62.50 level, but it struggled to gain momentum above the $63.00 resistance level. Later, it started a downside move and broke the key $62.50 support. Besides, there was a break below a significant ascending channel with support at $62.60 on the hourly chart of XTI/USD.

The price traded below the $62.40 level and the 50 hourly simple moving average. It tested the 23.6% Fib retracement level of the recent wave from the $58.29 low to $62.97 high.

If there is a downside break below the $62.00 support area, the price may move into a short term bearish zone. The next support is near the $61.50 level. If there are more losses, the price may even test the $60.60 support.

The 50% Fib retracement level of the recent wave from the $58.29 low to $62.97 high is also near the $60.60 level. On the other hand, if buyers protect the $62.00 support, the price could bounce back above $62.50 and it may even break the $63.00 resistance.