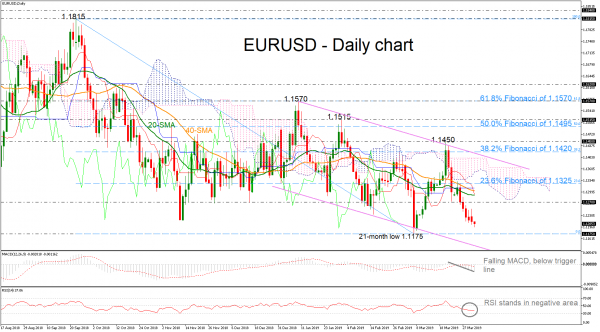

EURUSD lost ground in the previous couple of weeks but is still holding above the 21-month low of 1.1175. The world’s most traded pair has been developing within a downward aligned channel over the last three months and recorded a new one-month low of 1.1195.

The sharp bearish rally drove the pair well beneath the Ichimoku cloud and the 20- and 40-simple moving averages (SMAs) in the daily timeframe, re-entering the 1.1200 area. The technical indicators are feeding prospects for a possible negative trading; the RSI stands in the bearish territory with weak momentum, while the MACD is strengthening its movement below the trigger and zero lines.

If the 1.1200 psychological level proves easy to get through, the spotlight would turn to the 1.1175 barrier. Lower, support could be next found around 1.1115 where the lower boundary of the descending channel is currently positioned. More losses could send the price until the 1.0830 support, identified by the highs on January 2017.

On the other hand, if the negative structure weakens, the price could shift to the upside towards the immediate resistance of 1.1270. On top of that, the bulls would need to clear the SMAs to push the rally towards the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1175, around 1.1325. Above that zone, the upper boundary of the channel could come in focus near the 38.2% Fibonacci of 1.1420.

In the medium-term picture, a dive beneath 1.1175 would bring the bearish outlook into play again.