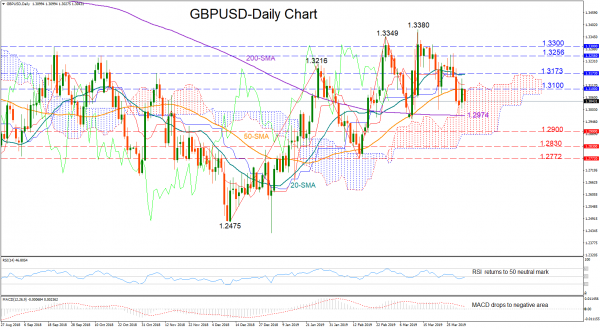

GBPUSD returned to the downside on Tuesday after Monday’s closing above 1.31. The RSI is suggesting neutral trading in the short term as the index is curving up to reach its 50 neutral mark. Yet with the MACD stepping into the negative territory, the risk could be skewed to the downside.

The 200-day moving average currently at 1.2974 could act as immediate support if negative momentum accelerates. If the line proves a weak obstacle, the 1.2900 psychological level could be the next level to watch before attention shifts to the 1.2830 congested region. Further down, a slip below the February 14 low of 1.2772 could stage a bigger sell-off.

On the flip side, a reversal to the upside could retest the 1.31 round level, while higher the bullish action may pause between 1.3173 and 1.3256 identified by the peaks on November 7 and October 12 respectively. Should the rally continue, the 1.33 level could be the door for a full recovery.

Meanwhile in the medium-term, the pair is still holding a positive status thanks to the higher highs and higher lows registered over the past three months. Any decline below 1.28 could feed speculation that the upward pattern is nearing an end.

In brief, GBPUSD looks neutral-to-bearish in the short term, while in the medium-term the market maintains a bullish profile.