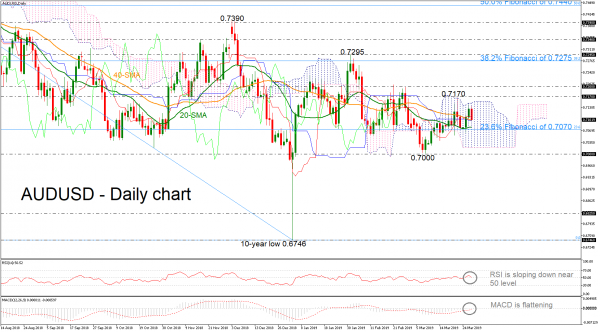

AUDUSD has been consolidating within the Ichimoku cloud since the price found strong support at the 0.7000 psychological level. The neutral picture in the short-term could last for longer if the bulls find hard to break above the upper line of the cloud as in the previous sessions.

The neutral bias is supported by the deterioration in the momentum indicators. The RSI is approaching its threshold of 50, while the MACD oscillator is flattening near the trigger and zero lines.

Should the price retreat further, immediate support may come from the 23.6% Fibonacci retracement level of the downward movement from 0.8135 to 0.6746, around 0.7070. A successful decline below this level could drive the pair until 0.7000 before a retest of the 0.6825 level, where the pair bottomed on January 2016.

In the alternative scenario, traders would be eagerly looking for a successful break of the Ichimoku cloud to increase buying orders, probably towards the 0.7170 – 0.7200 resistance zone. If bullish forces appear even stronger, the 0.7200 key level should be another resistance to keep in mind, while more upside pressure could touch the 38.2% Fibonacci of 0.7275.

Over the last seven months AUDUSD stands in a narrow range within the 0.7000-0.7390 area.