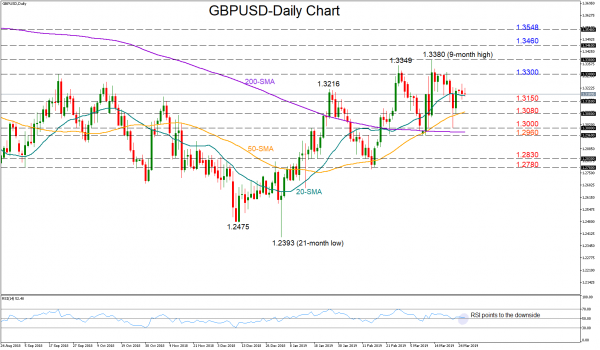

Following Thursday’s dive towards 1.30, GBPUSD returned to the 1.32 area to maintain the upward pattern it started in December. Meanwhile, the RSI seems to be losing ground in bullish territory, capturing a neutral picture for the short term.

The 1.33 round level would be the main target if positive momentum accelerates, while higher the bulls would attempt to beat previous peaks at 1.3349 and 1.3380. If efforts prove successful, buying orders could increase towards the 1.3460-1.3548 former resistance area, turning the medium-term outlook even more bullish.

On the flip side, the pair could find immediate support between 1.3150 and 1.3080 as it did last week. Below the latter, the bearish action could be trapped within the 1.30-1.2960 zone where the 200-day moving average (MA) has been flattening more than a month now. Should the price fall comfortably deeper, putting the December upleg into doubts, losses could continue until the 1.2830 and 1.2780 restrictive levels.

In brief, GBPUSD could experience a neutral situation in the short-term, while regarding the medium-term performance, the increasing distance between the 50- and the 200-day MAs suggests the continuation of the December upward pattern.