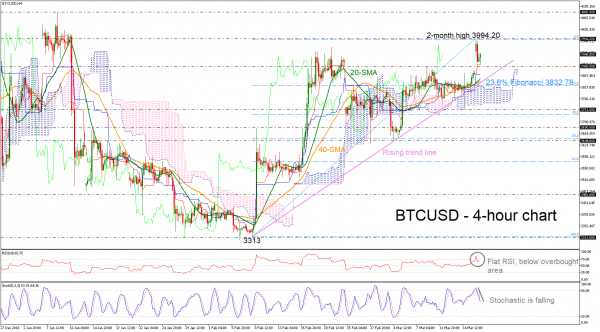

BTCUSD is currently developing below the two-month high of 3994.20 and back near the flat red Tenkan-sen line. According to the momentum indicators some weakness could emerge as both the RSI and the Stochastics are losing steam after a peak in the overbought territory.

Should the price extend higher, it could find immediate resistance at the 3994.20 level before touching the 4085 barrier, taken from the peak on January 8. Also, an advance above this region would increase speculation that a bullish move is in progress towards 4210, where the market topped on December 24.

On the other hand, should the bitcoin stretch south, immediate support could come from the 3900 inside swing and then closer to the 20- and 40-simple moving averages (SMAs) currently around 3850 in the 4-hour chart. A step lower could drive the price down to 3832.72, where the 23.6% Fibonacci retracement level of the upleg from 3313 to 3994.20 coincides with the rising trend line.

To sum up, the very short-term risk is tilted to the downside, though the upward extension off 3313 hints that buyers are still active in the market.