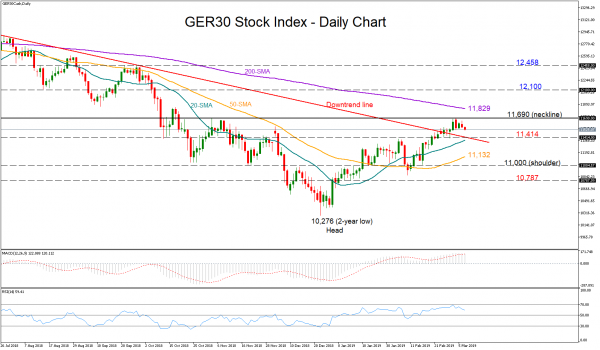

German 30 stock index (DAX 30) stretched above the June downtrend line but was unable to pierce the 11,690 neckline of the inverted head (10,276) and shoulders (11,000) pattern this week, with the price correcting lower instead.

The technical indicators suggest a neutral bias for the short term at the moment as the RSI is heading towards its 50 neutral mark and the MACD is moving around its red signal line. The risk, however, could turn to bearish if the former drops below 50 and the latter finally slips under the red line.

Should the market extend losses, a rebound could potentially emerge around 11,414, at the top of the downtrend line. Otherwise, the price could continue falling until it catches the shoulders at 11,000. Before that, however, the bears need to clear the 50-day moving average at 11,132. A close below the 10,787 support zone could open the way towards the 10,276 bottom.

On the upside, the bulls would have to violate the neckline around 11,690 and more importantly pierce the 200-day MA currently at 11,829 to take the bullish tendency to the next level. Higher, the August 15 low of 12,100 could pause bullish pressure before a stronger resistance appears around 12,458.