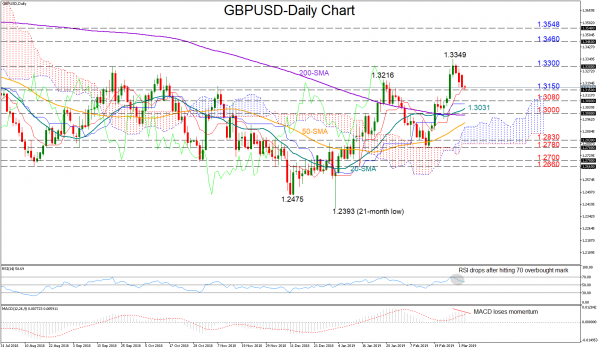

GBPUSD touched overbought levels at a seven-month high of 1.3349 according to the RSI which topped at 70 and reversed southwards to retest support around 1.3150. The RSI continues to weaken towards its 50 neutral threshold, while the MACD is also losing steam, both signalling that caution is likely to persist in the short term. Yet the upward-sloping 20-day moving average suggests that the recent uptrend is not near to its end.

The 1.3080-1.30 area could provide immediate support in case bearish action stretches below 1.3150. Under the 200-day MA (1.3000), the congested region between 1.2830-1.2780 could halt downside movements, while if this fails to hold too, traders could then look for support within the 1.27-1.2660 zone.

Otherwise, the pair could bounce up to challenge the 1.3300 level. If the market manages to rally above this point and more importantly clear the peak at 1.3349, resistance could be next found near 1.3460. Another successful upside break could bring 1.3548 into view, identified by the highs on November 2017.

In the medium-term picture, the rally towards seven-month highs has reactivated the uptrend started from the 1.2475 bottom, shifting the outlook from neutral to bullish. The 50-day MA has also improved significantly over the past two weeks and is now even closer to the 200-day MA, a sign that the market could turn more positive once the lines clearly cross each other.