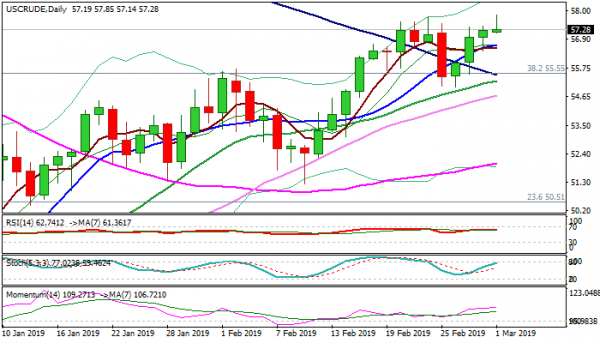

WTI oil cracked previous high at $57.79 (22 Feb) and posted new, marginally higher high at $57.85 on Friday, but was so far unable to sustain break.

The price holds in green for the fourth straight day, as solid US GDP and stronger than expected China’s Manufacturing data further brightened the outlook after oil advanced 2.5% on unexpected strong draw in US crude inventories (-8.6 mln bls vs 2.8 mln bls f/c).

Criticism of President Trump on high oil prices shook markets this week but negative impact was short-lived, as OPEC’s production cut along with above mentioned factors continues to inflate oil price.

Bullish daily studies support for final break above $57.79/85 highs for test of 100WMA ($58.32) and possible extension towards targets at $59.62/$60.00 (50% retracement of $76.88/$42.36/psychological barrier).

The WTI contract ended February in green, marking the second straight bullish month and is on track for the third consecutive bullish week, that adds to positive signals for extension of recovery leg from $42.36 (low 2018, posted on 24 Dec).

Rising 10SMA offers solid support at $56.69, which should ideally contain dips and guard more significant broken Fibo barrier at $55.55.

Res: 57.85; 58.32; 58.85; 59.62

Sup: 57.14; 56.69; 56.42; 55.55