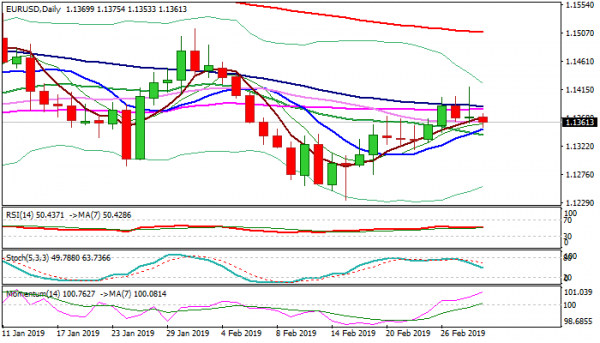

The Euro stands at the back foot in early Friday’s trading and eased to session low at 1.1353, on probe below 30SMA support at 1.1361, which held the action in past two days.

Stronger dollar on upbeat US GDP data increased pressure on single currency, as recovery rally stalled on Thursday (short-lived spike to 1.1419).

Formation of bull trap pattern on daily chart weighs and could result in further weakness.

Sustained break below 30SMA would generate initial bearish signal, which would require confirmation on close below 1.1350 (rising 10SMA / Fibo 38.2% of 1.1234/1.1419 upleg).

Daily studies are mixed and lack clearer direction signal as bullish momentum continues to strengthen, stochastic is heading south and MA are in mixed setup that could result in prolonged sideways mode while the pair holds above pivotal supports provided by 30 and 10SMA’s.

Better than expected German labor and retail sales data, released earlier today, provided little support to Euro, as traders eye EU CPI data for fresh signals.

Res: 1.1375, 1.1387, 1.1407, 1.1419

Sup: 1.1350, 1.1340, 1.1327, 1.1316