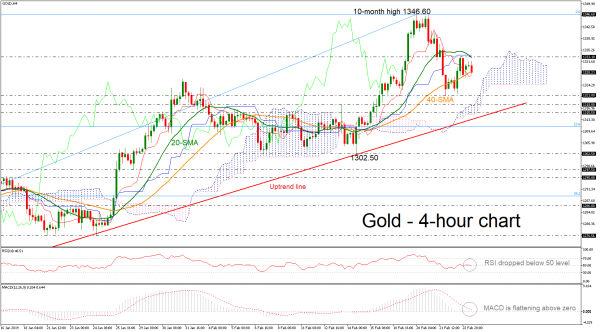

Gold prices are consolidating within the 20- and 40-simple moving averages (SMAs) in the 4-hour chart as well as within the red Tenkan-sen and blue Kijun-sen lines. The momentum indicators seem flat also, as the RSI is flattening near the neutral threshold of 50, while the MACD is holding above the zero line with very weak momentum in the short-term.

If the price surpasses the 1333.10 resistance level, which overlaps with the 20-SMA, this could send price towards the 10-month high of 1346.60. Immediate resistance to further gains would likely come from the 1357 barrier, taken from the highs on April 2018. If there is a successful break above this area, further resistance could be met around the 1365 strong obstacle, which halted bullish movements in the preceding year.

If the yellow metal reverses course, lower support would initially come from the 1321 level. Slipping below this level could take prices towards the 1315.50 – 1318 support zone, taken from the inside swing highs on February 8 and February 13 respectively. Failure to hold above this region would switch the focus back to the downside and would increasingly turn to the 23.6% Fibonacci of the upleg from 1196 to 1346.60 near 1311, penetrating the medium-term rising trend line.

In the more medium-term picture, the price is extending gains, endorsing the bullish view following the upward reversal at the 19-month low of 1160.