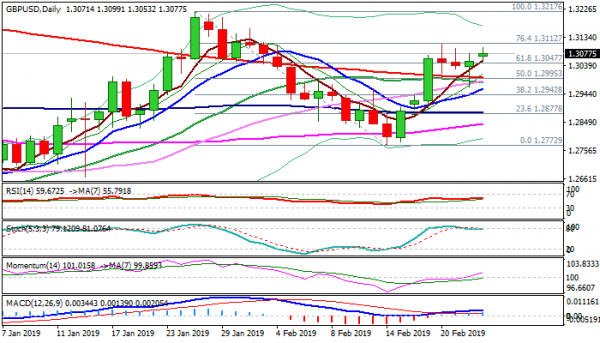

Cable holds in directionless mode for the fourth straight day, consolidating under 1.31 zone, where strong recovery rally stalled.

Near-term bias remains with bulls as broken 200SMA contained dips and continues to underpin, but triple-Doji frustrates bulls.

Rising bullish momentum and daily MA’s in positive configuration, so far offered little help, however, outlook remains positive with additional support from strong bullish weekly close and bullish techs.

Break above pivotal barriers at 1.3109/12 (20 Feb high / Fibo 76.4% of 1.3217/1.2772) is needed to signal an end of consolidative phase and continuation of rally from 1.2772 (14 Feb low) towards key barrier at 1.3217 (2019 high posted on 25 Jan).

Broken Fibo barrier at 1.3047 (61.8% of 1.3217/1.2772) narks initial support, guarding more significant 200SMA (1.2998), violation of which would weaken near-term structure.

Brexit story remains pound’s key driver and traders turn focus towards this week’s debate and Brexit vote on 12 March, which could be crucial to the Brexit outcome.

Res: 1.3112, 1.3160, 1.3217, 1.3257

Sup: 1.3047, 1.3026, 1.2998, 1.2962