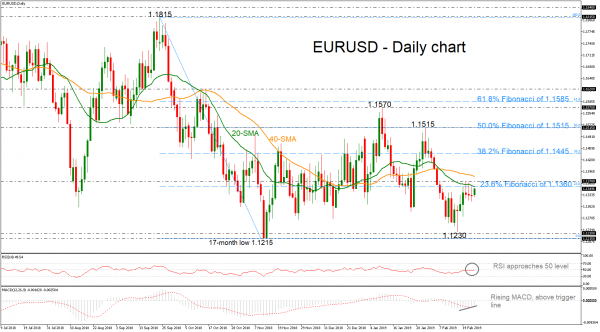

EURUSD has found a strong resistance obstacle on the 1.1370 and 1.1360 resistance area, which encapsulates the 20-day simple moving average (SMA) and the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1215. The pair rebounded on the three-month low around 1.1230 on February 15 and is trying to post a bullish recovery despite the several resistance levels.

Momentum indicators are pointing to a neutral to positive bias in the short term with the RSI just below 50 but pointing slightly up. However, the MACD oscillator has jumped above the trigger line and is approaching the zero line in the daily timeframe.

In the wake of more positive pressures above the aforementioned zone, the market could meet resistance at the 40-day SMA currently at 1.1383 before moving sharply higher towards the 38.2% Fibonacci of 1.1445. A stronger barrier though could be found around the 50.0% Fibonacci, which coincides with the 1.1515 level, taken from the highs on January 31.

On the other side, a move to the downside could find support near the 17-month low of 1.1215 and the 1.1230 region. Should the market increase negative momentum below this area, the 1.1115, reached on June 2018 could be the next level to look for.

Summing up, the very short-term bias looks bullish-to-neutral, while the medium-term outlook holds neutral as long as the price trades below the 61.8% Fibonacci of 1.1585.