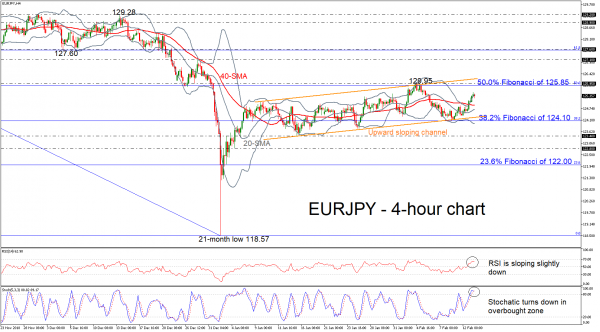

EURJPY is falling today after the strong jump above the 20- and 40-simple moving averages (SMAs) in the 4-hour chart. The pair is struggling within an upward sloping channel since January 15, finding strong resistance obstacle around the 50.0% Fibonacci retracement level of the downleg from 133.10 to 118.57, around 125.85 and the 38.2% Fibonacci of 124.10.

The technical indicators are still located in bullish area. However, there are indications that the upside rally is overdone as the RSI is stretching to the downside, while the %K line of the stochastic oscillator posted a bearish crossover with the %D line. Hence negative corrections should not be a surprise in the coming sessions.

If the market continues to move lower in the near term, the pair could touch the 40-SMA and the mid-level of the Bollinger band around 124.90 and 124.70 respectively. In case of an extension below this region, the pair could challenge the lower channel line near 124.40. Slightly below this line, the 38.2% Fibonacci of 124.10 could attract attention as well.

On the other side, if the market pushes the pair higher, the price could re-challenge the 50.0% Fibonacci and the 125.95 resistance area. More advances would likely open the door for the 127.10 resistance, taken from the highs on December 27.

In the longer timeframe, the price remains in a strong bearish structure following the pullback on 133.10 and only an advance above the 61.8% Fibonacci near 127.60 could confirm bullish correction mode.