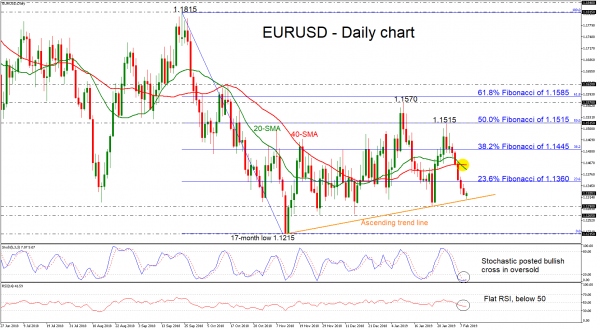

EURUSD has tumbled over the preceding five consecutive days, falling back below the 20- and 40-simple moving averages (SMAs) in the daily timeframe. Also, the SMAs posted a bearish crossover last Friday, signaling negative movement. Currently, the price is attempting a rebound on the near-term ascending trend line, around the 1.1300 psychological level, erasing some significant losses.

Looking at the technical indicators, the %K line of the stochastic oscillator recorded a positive cross with the %D line in the oversold zone, suggesting upside recovery, while the RSI indicator is flattening in the negative zone.

If prices continue to try to jump higher, immediate resistance level would come from the 23.6% Fibonacci retracement level of the downleg from 1.1815 to 1.1215, near 1.1360, while slightly above this area, the 20- and 40- SMAs lie around 1.1390 and 1.1400 respectively. Should the price surpass these lines, the 38.2% Fibonacci could act as resistance for the bulls at 1.1445. Moreover, the 50.0% Fibonacci of 1.1515 appeared a heavy obstacle for investors and therefore could gather extra attention when the price comes near this zone.

To the downside, the 1.1300 mark could be of psychological significance and therefore a potential support level to keep in mind is the uptrend line around this figure. Slipping lower, and breaking the diagonal line, would open the door for the 1.1265 – 1.1290 support area. If negative pressures become stronger, attention would shift towards the 17-month low of 1.1215.

To sum up, EURUSD has been maintaining a neutral to bullish outlook over the last three months, however, an advance above the 61.8% Fibonacci of 1.1585 would change the outlook to a strongly bullish one in the short-term.