Key Highlights

- Gold price rallied and broke the $1,300 resistance before correcting lower against the US Dollar.

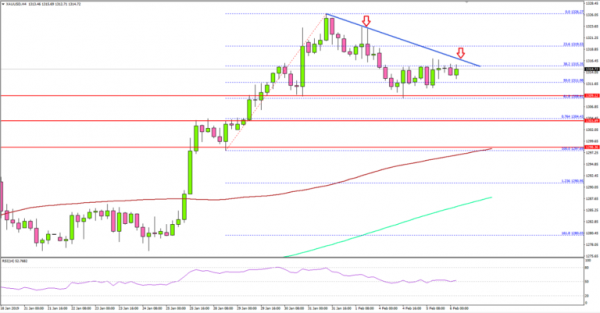

- There is a short term bearish trend line formed with resistance at $1,318 on the 4-hours chart of XAU/USD.

- The US Services PMI in Jan 2019 declined from 54.4 to 54.2.

- The US Trade Balance for Nov 2018 will be released today, which could post a deficit of $-54.0B.

Gold Price Technical Analysis

During the past few days, there was a solid rise in gold price above the $1,295 resistance against the US Dollar. The price surpassed the $1,300 and $1,320 resistance levels before starting a downside correction.

The 4-hour chart of XAU/USD indicates that the price traded as high as $1,326 and later corrected below the $1,320 and $1,315 support levels. There was a break below the 50% Fib retracement level of the last major upside from the $1,297 low to $1,326 high.

However, the decline was protected by the $1,308-1,310 support and pivot zone. The price tested and found support near the 61.8% Fib retracement level of the last major upside from the $1,297 low to $1,326 high.

It recovered above $1,312, but it is still facing a solid resistance near the $1,318-1,320 area. There is also a short term bearish trend line formed with resistance at $1,318 on the 4-hours chart of XAU/USD.

A clear break above the trend line might push the price back towards the $1,325 and $1,330 resistance levels. On the downside, there are many supports, including $1,310, $1,308 and $1,302. Therefore, only a daily close below $1,300 might start a major decline in gold price.

Recently, the US Services Purchasing Managers Index (PMI) for Jan 2019 was released by Markit Economics. The market was looking for no change from the last reading of 54.2.

However, the result was mixed as the US Services PMI came in at 54.2, but the last reading was revised up from 54.2 to 54.4. Therefore, there was a decline from 54.4 to 54.2.

Overall, gold price remains supported on dips as long as there is no daily close below the $1,300 support level in the near term.

Economic Releases to Watch Today

- German Factory Orders for Dec 2018 (MoM) – Forecast +0.3%, versus -1.0% previous.

- US Trade Balance Nov 2018 – Forecast $-54.0B, versus $-55.5B previous.

- Canada’s Ivey PMI Jan 2019 – Forecast 56.0, versus 59.7 previous.