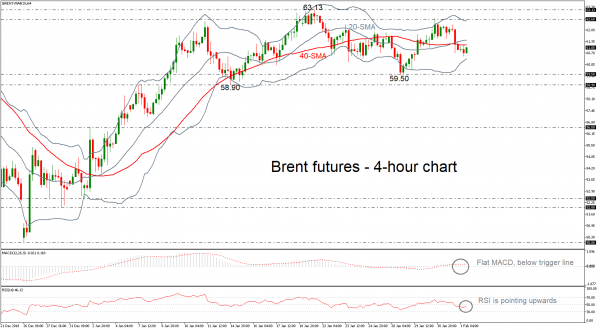

Brent crude oil futures have been moving sideways within the Bollinger bands over the last three weeks, failing to create a significant movement. The RSI indicator suggests that the market might improve in the coming sessions as it is pointing upwards, however, the MACD oscillator is flattening near the zero line, confirming the recent trend in the 4-hour chart.

Should the price move higher, it would increase the chances for an extension of the bullish correction but would first face immediate resistance at the 62.60 barrier, which stands near the upper Bollinger band. Above that, the area around 63.13 could be another potential hurdle in focus.

On the flipside, if the price manages to drop below the lower Bollinger band, nearby support could come from the 59.50 barrier. A decisive close below the latter level would drive the price towards the 59.50 – 58.90 support zone.

In the short-term picture, the price currently stands below the 20- and 40-simple moving averages (SMAs) but the structure remains neutral.