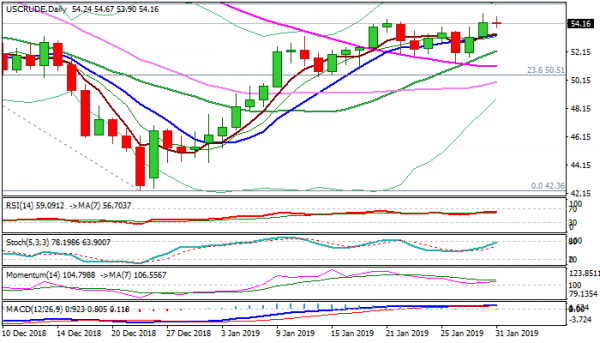

WTI oil consolidates under new nine-week high at $54.91, posted on Wednesday, after oil extended gains on weaker dollar after dovish Fed. Eventual break above recent congestion to ($54.54) was initial signal that consolidative phase is over and bulls look for extension of recovery rally from $42.36 (24 Dec low, the lowest in 2018). Several factors support scenario, soft tone from Fed that could keep the greenback under pressure, better than expected data from China, which revive hopes for steady demand, political turmoil in Venezuela that threats supply disruption and lower than expected rise of US crude inventories. Bulls need close above cracked former high at $54.48 (21 Jan) and extension through pivot at $55.55 (Fibo 38.2% of $76.88/$42.36) to generate stronger signal for continuation. Broken ascending 10SMA ($53.38) offers solid support which should ideally contain and keep bullish bias intact. Ascending 20SMA marks pivotal support at $52.21, violation of which would soften near-term tone and sideline bulls.

Res: 54.67, 54.91, 55.55, 56.00

Sup: 53.90, 53.38, 52.65, 52.21