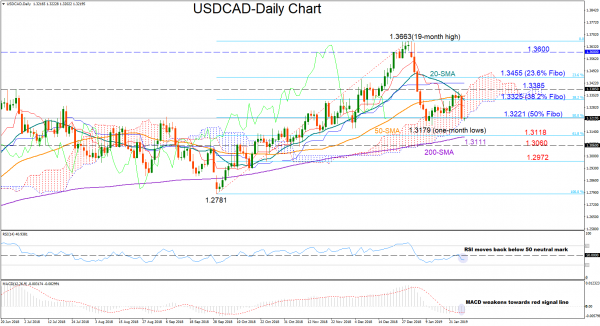

USDCAD lost almost 1% on Friday, reversing all the gains it gathered to close negative in the previous week. While negative momentum has somewhat slowed down on Monday, the RSI and the MACD suggest that the downside is likely to continue as the former weakens below its 50 neutral threshold and the latter returns below its red signal line.

An extension lower could reach the previous low of 1.3179, whereas any violation at this point would open the way towards the 200-day simple moving average which currently stands at 1.3111; marginally below the 61.8% Fibonacci of the upleg from 1.2781 to 1.3663. Should the bears beat that obstacle too, support could then run towards the 1.3060-1.2972 congested area.

On the flipside, a rally above the 50% Fibonacci of 1.3221, could potentially stop near the 38.2% Fibonacci of 1.3325, while resistance between 1.3370-1.3385 should be kept in mind as well. Slightly higher the 23.6% Fibonacci of 1.3455 could also halt upside movements, while the 1.3600 round level is expected to be a bigger challenge as any decisive close above that mark could reassure that the uptrend off 1.2781 is not over yet.

Turning to the medium-term picture, the pair has erased half of its rebound from the 1.2781 trough, shifting the bullish outlook to a neutral one. Still, a confirmation that the bullish phase has ended, may come only below the one-month low of 1.3179.