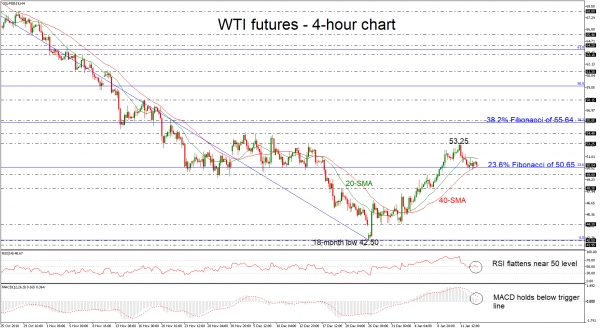

West Texas Intermediate (WTI) crude oil futures are finding strong support level on the 23.6% Fibonacci retracement level of the sharp downward movement from 76.90 to 42.50, around 50.65. The technical indicators suggest that there are still some investors that could hold the market on the downside; the MACD is moving lower below its red signal line, while the RSI has turned slightly to the downside below 50 level.

Should the price retreat, the 40-simple moving average (SMA) in the 4-hour chart, which coincides with the 23.6% Fibonacci could be the next immediate level to watch. Below that, the area near 49.80, taken from the inside swing high on January 7 could be another significant barrier. More losses could see the 48.30 support region.

On the other side, if the oil heads higher it could find nearby resistance at 53.25. Further up, the price could rest around the 54.40 resistance, reached by the high on December 5. A decisive close above the latter could push oil prices until the 38.2% Fibonacci of 55.64.

To summarize, oil futures currently stand in a bullish correction mode in the very short term, while looking at the bigger picture the market could shift the outlook to a more positive one if there is a successful close above 38.2% Fibonacci.