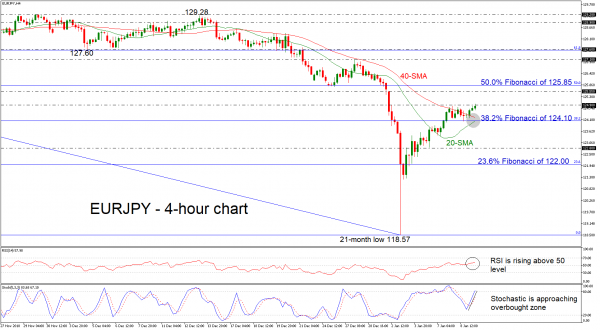

EURJPY has been edging higher since the price found strong support at the 21-month trough, registered on January 3 and surpassed the 38.2% Fibonacci retracement level of the downleg from 133.10 to 118.57, around 124.10. It is worth mentioning that the 20-simple moving average (SMA) is ready to post a bullish cross with the 40-SMA in the 4-hour chart, suggesting further gains. According to the RSI, the short-term bias seems to be positive as it holds in the bullish area, while the stochastic oscillator is approaching the overbought territory.

If the market continues to push the pair even higher, prices could challenge the 125.55 resistance level, taken from the August on August 17. More advances could likely open the way for the immediate resistance of the 50.0% Fibonacci of 125.85, while traders’ attention could turn on the 127.10 hurdle, identified by the peak on December 27.

On the flipside, if the market manages to turn to the downside again and slips back below the 38.2% Fibonacci and the moving averages in the near term, this could send prices until the 122.80 support level before touching the 23.6% Fibonacci of 122.00.

Overall, EURJPY has been in a bullish correction mode, however, in the longer timeframe the price remains in a strong bearish structure following the pullback on 133.10.