Wall Street extends payrolls gains

Wall Street continued Friday’s gains yesterday, though closed off intra-day highs. There wasn’t much news from the two-day US-China trade talks for markets to latch on to, though the US expressed some confidence that a deal could be struck the both parties could “live with”.

US30USD Daily Chart

The US30 index looks set to advance for a third straight day amid hopes for progress in the Sino-US trade talks

The index is still eyeing the 50% retracement level of the December drop, which is at 23,760

The ISM non-manufacturing PMI for December came in worse than expected 57.6, echoing weakness in the manufacturing sector. There are no tier-1 data releases scheduled for today.

DE30EUR Daily Chart

The Germany30 index’s advance faltered yesterday, closing down on the day after touching a three-week high

The 55-day moving average is at 11,146. This average has capped prices on a closing basis since August 29

ECB’s De Guindos reiterates the Council’s view that the central bank will continue to provide substantial accommodation.

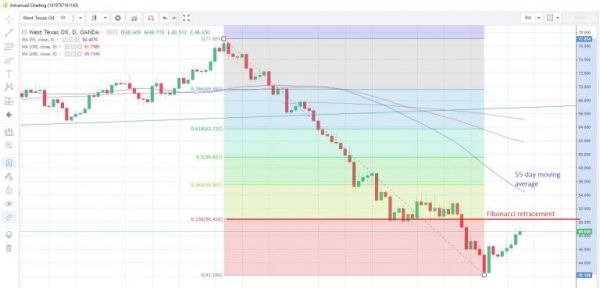

WTICOUSD Daily Chart

West Texas Intermediate advanced for a fifth straight day yesterday amid reports Saudi Arabia had scaled back production in December, as it had promised

The 23.6% Fibonacci retracement of the October-December drop is at $50.416. The 55-day moving average is at $54.407

American Petroleum Institute weekly crude stocks data as of Jan 4 are due today. Last week saw a draw-down on inventories of 4.5 million barrels, the first in three weeks.