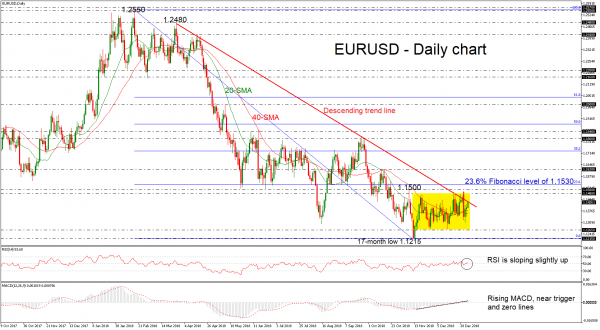

EURUSD is challenging the long-term descending trend line, creating positive movement in the narrow range. The price has been developing within a consolidation area over the last three months with the 1.1480 resistance level as the upper boundary and the 1.1265 support barrier as the lower boundary. If the price jumps above the diagonal line, it would change the outlook to a more neutral one.

Momentum indicators in the short-term though are currently supporting that neutral momentum. Specifically, the RSI indicator is pointing somewhat upwards near 50, while the MACD oscillator continues to stand marginally above the trigger and zero lines, moving positively and signaling a slightly bullish mode.

In case of a climb above the falling trend line, the pair could find a stop around the 1.1480 – 1.1500 resistance area, before hitting the 23.6% Fibonacci retracement level of the downleg from 1.2550 to 1.1215 around 1.1530. More advances could send prices towards the 1.1620 resistance, taken from the high on October 16.

On the flipside, should the pair experience negative pressure, it could challenge the 20- and 40-day simple moving averages (SMAs) around the 1.1370 barrier, before the price heads sharply lower towards the 1.1265 support level. In case of steeper declines, the pair could breach this trough, diving to the 17-month low of 1.1215, which was reached on November 13.

To sum up, bulls seem to be ready to break above the descending trendline, however, there are significant obstacles remaining before posting a sharp bullish rally in the short term.