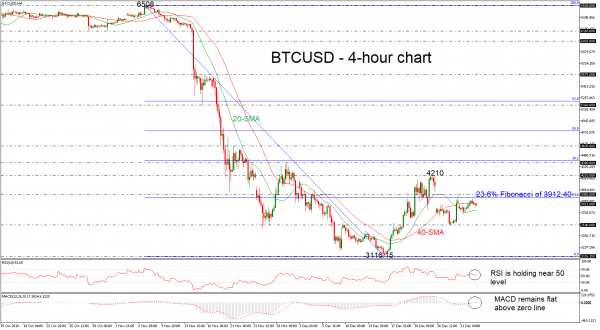

BTCUSD has been moving sideways after it found strong support at the 3116.15 barrier on December 14. The price holds within the 20- and 40-simple moving averages (SMAs) in the 4-hour chart, while the RSI indicator stands around the neutral level and is pointing slightly up. Moreover, the MACD oscillator is losing momentum near the zero line.

Resistance could occur around the 23.6% Fibonacci retracement level of the downleg from 6508 to 3116.15 of 3912.40. Slightly above this area, the 3950 resistance could come in focus. Higher still, the 4210 taken from the highs on December 24 would increasingly come into scope.

On the downside, the bitcoin may meet immediate support at the 20-SMA around 3747 before heading lower to the 3540 support hurdle. If the market manages to drop below this level and bearish actions take place again, traders could look for the next support at the multi-month low of 3116.15

To sum up, the short-term bias remains neutral bearish especially after BTCUSD plunged below the 23.6% Fibonacci.