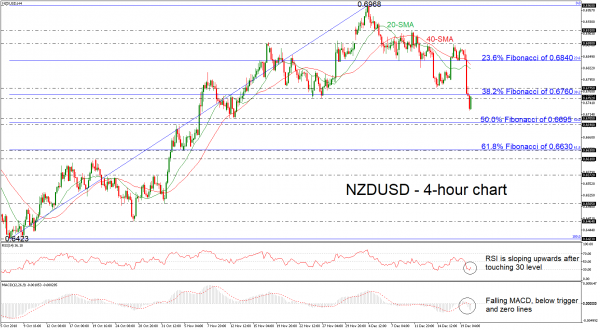

NZDUSD has rebounded somewhat after falling to five-week low of 0.6723 and momentum indicators now suggest that the market sentiment might get better as the RSI is reversing back to the upside after hitting the oversold zone. However, the MACD oscillator is still strengthening its bearish bias below the trigger and zero lines.

In case the pair continues the negative retracement, the bears will probably challenge the bottom of 0.6705 – 0.6690, which encapsulated the 50.0% Fibonacci retracement level of the upleg from 0.6423 to 0.6968. Additional declines may drive the price towards the 61.8% Fibonacci mark of 0.6630, shifting the short-term upside tendency to a more neutral one.

In case the pair changes its very short-term direction to the upside, the bulls will probably challenge the 0.6752 resistance and the 38.2% Fibonacci mark of 0.6760. A break higher, could last until the 0.6775 resistance level, taken from the inside swing bottom on December 14. Further up the area around the 23.6% Fibonacci of 0.6840 could be another potential obstacle to upward movements. It is noteworthy that the price needs to surpass the 20- and 40-simple moving averages (SMAs) before touching the 23.6% Fibonacci.

Summarizing, NZDUSD is edging higher after the sharp sell-off in the preceding sessions in the 4-hour chart, which had created a bearish correction.