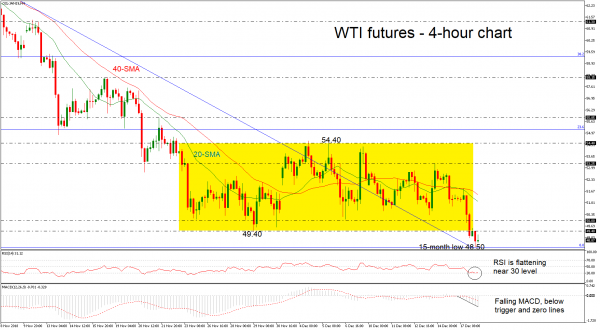

WTI futures plummeted to a fresh 15-month low during yesterday’s session, challenging the 48.50 level. The price exited from the narrow range that was holding in the preceding three weeks, continuing the strong downside structure in the short to medium term.

Currently, the price remains below the 20- and 40-simple moving averages (SMAs) and the technical indicators hold in negative area. The RSI is flattening near the overbought levels, while the MACD is strengthening its negative momentum below the trigger and zero lines.

Further declines and a drop below the aforementioned 15-month trough could send prices towards the 47.50 support barrier, registered on September 2017. Even lower, support could occur around the 46.00 handle, identified by the lows on August 2017.

On the upside, resistance could come around the 20- and 40-simple moving averages (SMAs) in the 4-hour chart, at 51.15 and 51.50 respectively. Higher still, the 53.25 resistance would increasingly come into scope before the price retouches the 54.40 obstacle, which was acting as upper band of the trading range in the previous days.

Overall, the short-term outlook appears mostly bearish after the break of the trading range, and the medium-term one remains negative as well.